Dallas (UK) Ltd is a wholly owned subsidiary of a US parent and has been set up

Question:

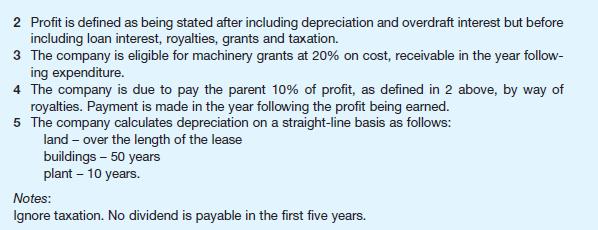

Dallas (UK) Ltd is a wholly owned subsidiary of a US parent and has been set up as a new manufacturing facility in the UK. The projected capital costs and sources of funds are as follows:

Costs Buildings: £1,500,000 paid at the start of year 1.

Land: leased for 100 years for a single payment of £120,000 Machinery: £500,000 initial payment at the start of year 1 and £50,000 per annum subsequently on the first day of each year.

Financing Share capital: £600,000 Special area cash grant £520,000 spread evenly over four years.

Long-term loan: £1,000,000 for eight years at 5% with capital repayments of one-quarter in each of the last four years at the end of the year.

Medium-term loan: £500,000 for five years at 8% with repayments in equal instalments at the end of each year. The loan is received at the start of year 1.

Overdraft facility: £1,400,000 (interest assumed constant at 9% on actual usage).

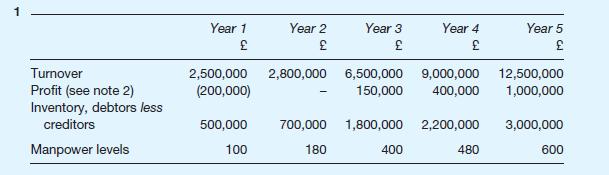

The following details are available from the profit forecasts prepared to support the new factory:

Required Prepare calculations to show whether the overdraft facility is adequate to finance the business over its first five years.

Step by Step Answer: