Foresight Ltd plans an investment in fixed assets costing 120m. The project will have a threeyear life,

Question:

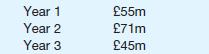

Foresight Ltd plans an investment in fixed assets costing £120m. The project will have a threeyear life, with the predicted cash flows as:

Finance for inventories and debtors amounting to £75m will be required at the start of the project. Trade credit will provide £45m of this amount. All working capital will be recovered at the end of year 3. The expected scrap value of fixed assets at the end of year 3 is £15m. The cost of capital is 10%. Taxation is to be ignored.

Required

(a) Calculate the net present value of the project.

(b) Show that the project can pay interest at 10% per annum on the capital invested and return a surplus equivalent to the net present value calculated in (a).

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: