Question: PB21-1 Analyzing Mixed Costs Using High-Low Method, Preparing a Contribution Margin Income Statement, Analyzing Break-Even Point, and Setting Target Profit Tina Sutton delivers flowers for

PB21-1 Analyzing Mixed Costs Using High-Low Method, Preparing a Contribution Margin Income Statement, Analyzing Break-Even Point, and Setting Target Profit Tina Sutton delivers flowers for several local flower stores. She charges clients $0.85 per mile driven. Tina has determined that if she drives 1,200 miles in a month, her average operating cost is $0.70 per mile. If she drives 2,000 miles in a month, her average operating cost is $0.60 per mile. Required: 1. Using the high-low method, determine Tina’s variable and fixed operating cost components. Show this as a cost formula. 2. Determine how many miles Tina will need to drive to break even. 3. Assume Tina drove 900 miles last month. Without making any additional calculations, determine whether she earned a profit or a loss last month. 4. Prepare a contribution margin income statement for Tina’s business last month. 5. If Tina wants to earn $800 a month, determine how many miles she must drive. PB21-2 Preparing a Contribution Margin Income Statement and Analyzing Break-Even Point StaySafe Company produces one model of security door. A partially complete table of company costs follows.

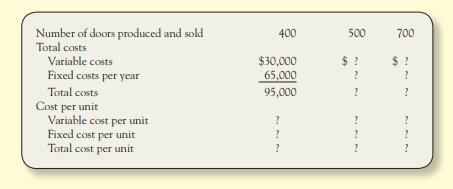

Required: 1. Complete the table. 2. StaySafe sells its doors for $200 each. Prepare a contribution margin income statement for each of the three production levels in the table. 3. Based on these three statements (and without any additional calculations), estimate StaySafe’s break-even point in units. 4. Calculate Staysafe’s break-even point in number of units and in sales dollars. 5. Assume StaySafe sold 600 doors last year. Without performing any calculations, determine whether StaySafe earned a profit last year.

Number of doors produced and sold Total costs Variable costs Fixed costs per year Total costs Cost per unit Variable cost per unit Fixed cost per unit Total cost per unit 400 500 700 $30,000 $ ? $ ! 65,000 2 95,000 ? 2 ?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts