You are the accountant of Hill Ltd (Hill), an electrical retailer having a chain of shops. Hill

Question:

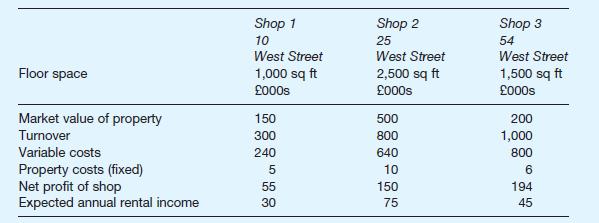

You are the accountant of Hill Ltd (‘Hill), an electrical retailer having a chain of shops. Hill has recently acquired two other similar businesses. The sales director has come to you with a problem regarding one particular street which now has three shops owned by Hill, each displaying and selling the same product range. The sales director has approached a local property agent who has given an indication of the likely rental income from each shop, should Hill decide to let any or all of them.

Further information 1 The average level of working capital for a shop is expected to be 15% of turnover.

2 If all sales were concentrated on shop 2 then the turnover could be as high as £2.1m or as low as £1.6m. In either case the ratio of variable costs to sales and the amount of fixed property costs would be the same as they are for shop 2 alone.

The sales director has heard that calculating return on investment is the best way of deciding divisional performance but has accepted your offer to compare the return on investment with the residual income, calculated on the basis of an interest rate of 10% per annum. He has asked you to consider whether performance would improve if all sales were concentrated on shop 2 for continued retail use, leaving shops 1 and 3 available for rental.

Required Prepare a memorandum to the sales director of Hill containing:

(1) Appropriate calculations of return on investment and residual income.

(2) Brief comments explaining the usefulness of the residual income approach in the context of the particular situation faced by Hill.

Step by Step Answer: