A group of university students set up a new society for students interested in all things accounting.

Question:

A group of university students set up a new society for students interested in all things accounting. It was an nprecedented success, and the University Business School saw an opportunity to involve local businesses and thus changed the society from one informally run by students to one organized by the university itself. The society offers work experience to student members and training to business members. All student members are invited to the end of year ball in May. Student membership is £10 per year. As long as the society pays the £60 registration fee it can remain a part of the student union. Memberships were offered to local businesses for £25 annual fee. The Accounting Society offers a bookkeeping service to the other societies for a £20 charge. (This is not applicable to the local businesses.) Member businesses can access up to 12 hours of training for their staff for a £250 fee. Additional training costs £25 per hour. The majority of training is provided by the students but some has been carried out by business school staff. Details of income and expenditure from the last financial period are as follows:

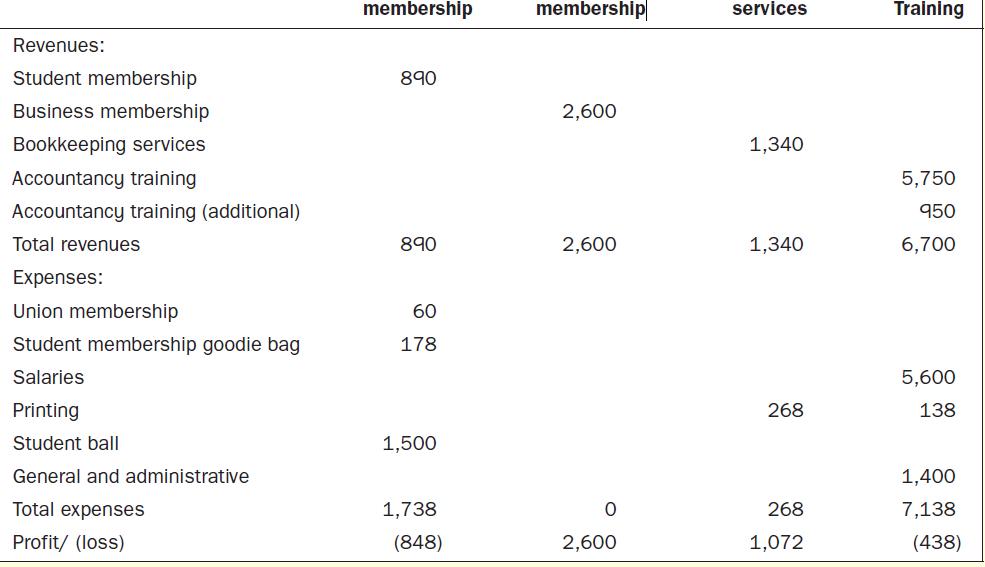

The leadership team has asked for a breakdown of revenue and expenditure based on the different sectors of the society:

• Student membership

• Business membership

• Accountancy services

• Accountancy training

In particular, they need to see a clear distinction between student activity and business school activity. There are 89 student members and 104 local business members; 67 other university societies used the bookkeeping service last year; 23 businesses took up the option of training. As well as this, 38 additional hours of training were billed; Goodie bags were given out to student members at a cost of £2 per bag; to oversee the Business School involvement, a charge of £5,600 for salaries and £1,400 for general administration was passed to the society. This is allocated to the provision of training to businesses. Printing costs were £4 for each society for bookkeeping and £6 for each client who took up training. £1,500 was budgeted for the student ball. Being accountants, this was exactly what it cost in the end.

Required

1. What is the total revenue from memberships?

2. What is the total revenue from training?

3. Calculate the revenue amounts to be allocated to each of the four different sectors.

4. What is the total cost of goodie bags?

5. What is the total cost of providing training services?

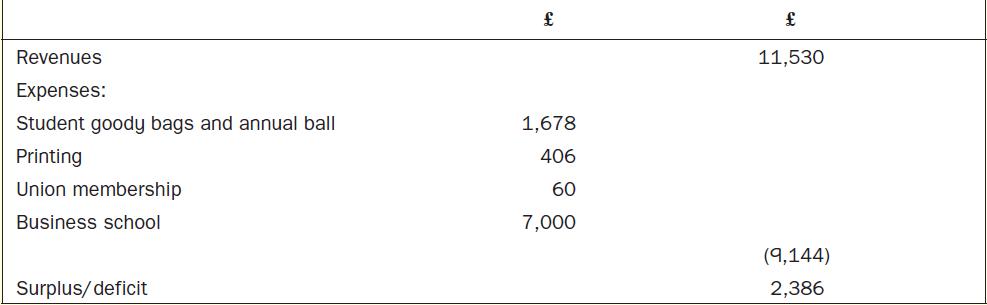

6. Calculate the amount of expenditure to be charged to each of the four sectors. After allocating the income and expenditure to the different sectors, the summary is as shown:

7. Calculate the profit margin for the bookkeeping services.

8. Which membership includes 46% of members but only 26% of membership revenue?

Step by Step Answer:

Management Accounting

ISBN: 9780077185534

6th Edition

Authors: Will Seal, Carsten Rohde, Ray Garrison, Eric Noreen