Answer the following: (a) A company sold building for cash at 100 lakh. The profit and loss

Question:

Answer the following:

(a) A company sold building for cash at ₹100 lakh. The profit and loss account has shown ₹40 lakh profit on sale of building. How will you report it in cash flow statement (based on AS-3)?

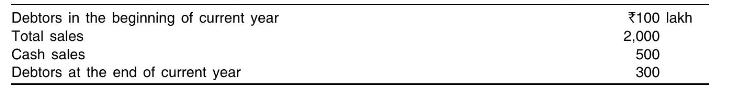

(b) From the following information, determine cash received from debtors during current year:

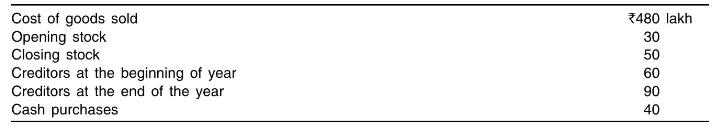

(c) Determine cash paid to suppliers/creditors from the following data during current year:

(d) From the following (i) determine the gross amount of plant and machinery purchased and (ii) depreciation charged during the current year.

\(\boxtimes\) Plant assets (net of depreciation) at year-end ₹285 lakh and at the year-beginning ₹127 lakh.

\(\boxtimes\) Gross plant assets increased by ₹186 lakh even through machine costing initially ₹ 58 lakh with book value of ₹38 lakh was sold at loss of ₹ 25 lakh.

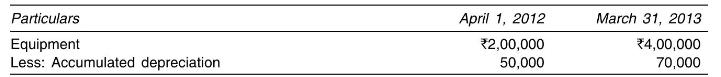

(e) Account balances relating to equipment during 2012-13 are as follows:

Equipment with an original cost of ₹40,000, having an accumulated depreciation of ₹20,000, were sold at a gain of ₹5,000. Determine: (i) Cash provided by the sale of equipment; (ii) Cash used to acquire equipment; (iii) Depreciation expense on equipment during 2012-13.

(f) Would your answer for

(e) (i), (ii) and (iii) be different if the equipment were sold at a loss of ₹ 5,000 ?

Step by Step Answer:

Management Accounting Text Problems And Cases

ISBN: 9781259026683

6th Edition

Authors: M Y Khan, P K Jain