Question: Given below is the Trial Balance (rounded off to rupees thousands) of Supreme Chemical limited as at the end of their financial year 201213 and

Given below is the Trial Balance (rounded off to rupees thousands) of Supreme Chemical limited as at the end of their financial year 2012–13 and additional information to be considered while preparing the final accounts which you are required to do in details. You may ignore the required format of company law in this regard:

Additional Information:

(i) Stock at the end of March 31, 2013. Raw materials ₹1,50,050 thousand; Work-in-process ₹1,25,200 thousand; Finished goods ₹3,79,750 thousand;

(ii) Market value of investments ₹1,050 thousand.

(iii) Sundry debtors include ₹605 thousand due for more than six months out of which provision has been made for doubtful debts at ₹225 thousand during the year.

(iv) Income tax is to be provided at 35 per cent of taxable income.

(v) The authorised capital of the company is 100 lakh equity shares of ₹10 each.

(vi) ₹1,700 thousand are to be re-transferred from Development rebate reserve A/c.

(vii) Included in other expenses are:

(a) Fees to auditors ₹325 thousand out of which ₹75 thousand are in other capacities.

(b) Interest on fixed loans ₹3,100 thousand and other interest ₹5,000 thousand.

(viii) Provision is to be made for managing director’s remuneration at 5 per cent of the net profits as provided under law, subject to the maximum of ₹600 thousand per annum.

(ix) Balance of profits is to transferred to general reserve after providing for dividend at 25 per cent on capital.

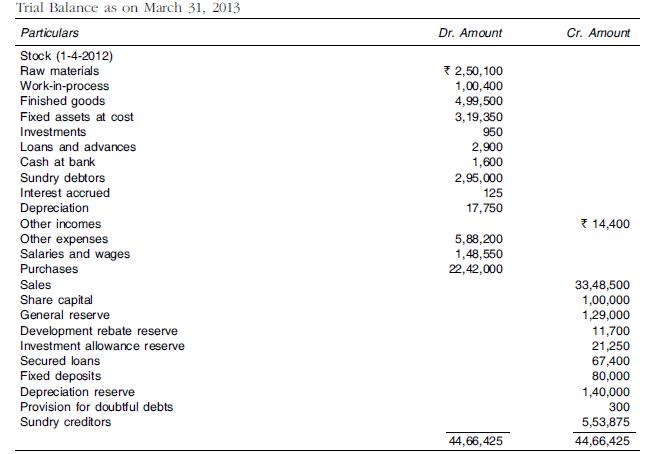

Trial Balance as on March 31, 2013 Particulars Stock (1-4-2012) Raw materials Work-in-process Finished goods Fixed assets at cost Investments Loans and advances Cash at bank Sundry debtors Interest accrued Depreciation Other incomes Other expenses Salaries and wages Purchases Sales Share capital General reserve Development rebate reserve Investment allowance reserve Secured loans Fixed deposits Depreciation reserve Provision for doubtful debts Sundry creditors Dr. Amount * 2,50, 100 1,00,400 4,99,500 3,19,350 950 2,900 1,600 2,95,000 125 17,750 5,88,200 1,48,550 22,42,000 44,66,425 Cr. Amount 14,400 33,48,500 1,00,000 1,29,000 11,700 21,250 67,400 80,000 1,40,000 300 5,53,875 44,66,425

Step by Step Solution

3.55 Rating (162 Votes )

There are 3 Steps involved in it

Net profit 111... View full answer

Get step-by-step solutions from verified subject matter experts