Dave Pens plc is a subsidiary of a writing instruments company. Dave Pens plc manufactures ballpoint pens,

Question:

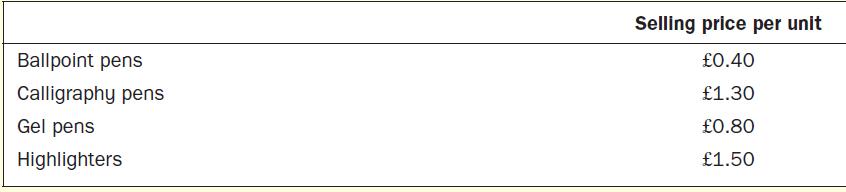

Dave Pens plc is a subsidiary of a writing instruments company. Dave Pens plc manufactures ballpoint pens, calligraphy pens, gel pens and highlighters. The current selling price per unit of all four categories of pen are given below:

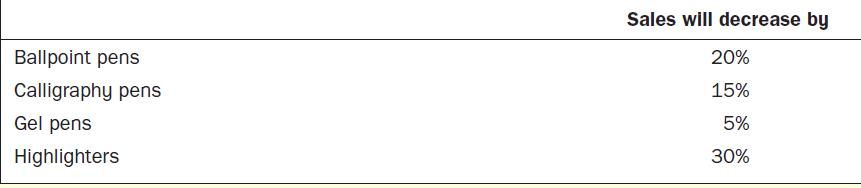

The management of the company is planning to increase the selling price of all categories of pens by 10%. The increase in the selling price will have the following impact on the sales of pens:

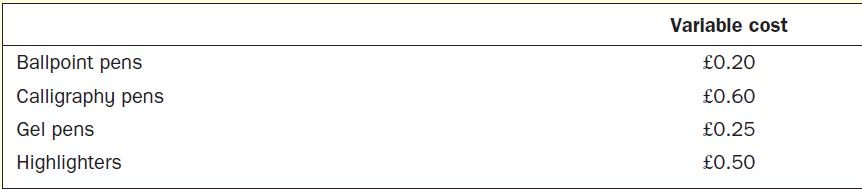

Currently, the company sells 500,000 ballpoint pens, 150,000 calligraphy pens, 300,000 gel pens and 250,000 highlighters in a month. The variable costs incurred per unit for each of the pens is given below:

Required

1. Determine the price elasticity of demand for all four types of pen manufactured by Dave Pens plc.

2. If the change in the price of ballpoint pens has no effect on the company’s fixed costs or on the other products, then:

(a) analyse how the increase in the price of ballpoint pens affects the profit arising from the sale of ballpoint pens.

(b) analyse how the increase in the price of calligraphy pens affects the profit arising from the sale of calligraphy pens.

3. Determine profit-maximizing price for both ballpoint pens and calligraphy pens and compare these prices with the existing prices.

4. Determine the profit-maximizing price for both gel pens and highlighters and compare these prices with the existing prices.

Step by Step Answer:

Management Accounting

ISBN: 9780077185534

6th Edition

Authors: Will Seal, Carsten Rohde, Ray Garrison, Eric Noreen