During the current year AB Ltd planned to produce 150,000 units of its main product, a cordless

Question:

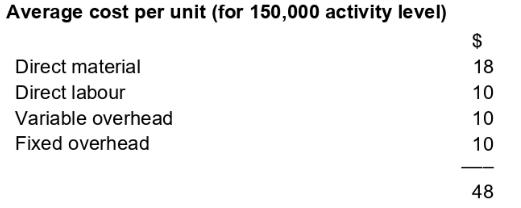

During the current year AB Ltd planned to produce 150,000 units of its main product, a cordless hand drill. Nearing the end of the current year, activity so far has corresponded to budget and it is anticipated that average costs for the whole year will be as shown below:

The budget for next year is being developed and the following cost changes have been forecast:

Direct material: price increase of $33.3 \%$

Director labour: rate increase of $10 \%$

Variable overhead: increase of $5 \%$

Fixed overhead: increase of $15 \%$

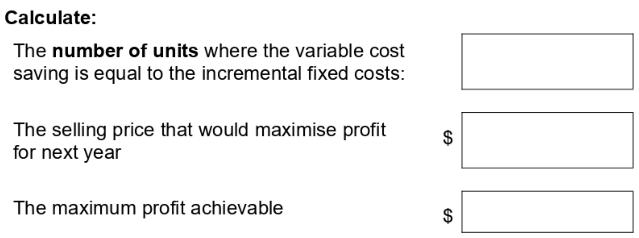

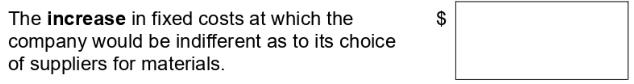

The substantial price increase for materials is causing concern and alternative sources are being considered. One source quotes a material cost per unit of $\$ 20$ but tests on samples show that the cheaper materials would increase labour costs by an additional 50c per unit and would lead to a reject rate of $5 \%$. It would also be necessary to install a test and inspection department at the end of manufacturing to identify the faulty items. This would increase fixed costs by an additional $\$ 200,000$ per year.

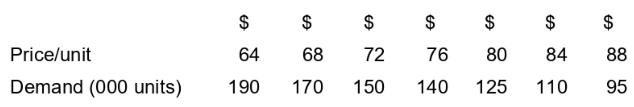

Selling prices are also considered when the budget is being developed. Normally, selling prices are determined on a cost-plus basis, the markup being $50 \%$ on unit cost, but there is concern that this is too inflexible as it would lead to a substantial price rise for next year. The sales director estimates that demand varies with price thus:

It has been realised that, through better organisation, it would be possible to reduce the extra fixed costs of $\$ 200,000$ originally estimated in connection with the cheaper material.

Required:

Step by Step Answer: