Evergreen Outdoor School (EOS) has a chance to invest $10,000 in a project that is certain to

Question:

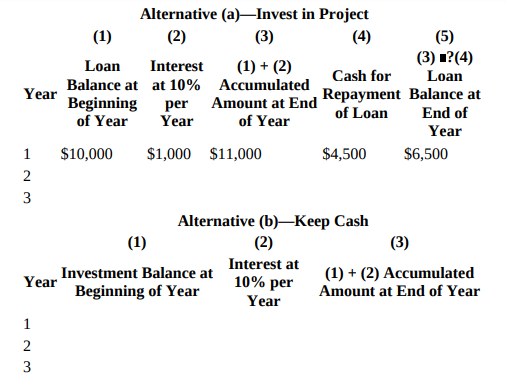

Evergreen Outdoor School (EOS) has a chance to invest $10,000 in a project that is certain to pay $4,500 at the end of each of the next three years. The minimum desired rate of return is 10 percent.

1. What is the project’s net present value?

2. Show that EOS would be equally well off undertaking the project as having its present value in cash. Do this by calculating the cash available at the end of three years if (a) $10,000 is borrowed at 10 percent, with interest paid at the end of each year, and the investment is made, or (b) cash equal to the project’s NPV is invested at 10 percent compounded annually for three years. Use the following formats. Year 1 for the first alternative is completed for you.

What is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at...

Step by Step Answer:

Management Accounting

ISBN: 978-0132570848

6th Canadian edition

Authors: Charles T. Horngren, Gary L. Sundem, William O. Stratton, Phillip Beaulieu