Kiku Yamamoto is the controller of Watanabe Inc., an electronic controls company located in Osaka. She recently

Question:

Kiku Yamamoto is the controller of Watanabe Inc., an electronic controls company located in Osaka. She recently attended a seminar on activity-based costing (ABC) in Tokyo. Watanabe’s traditional cost accounting system has three cost categories: direct materials, direct labour, and indirect production costs. The company allocates indirect production costs on the basis of direct labour cost. The 2010 budget for the automotive controls department is (in thousands of Japanese yen):

Direct materials .....................................¥ 60,000

Direct labour ............................................35,000

Indirect production costs ........................24,500

Total cost ..............................................¥119,500

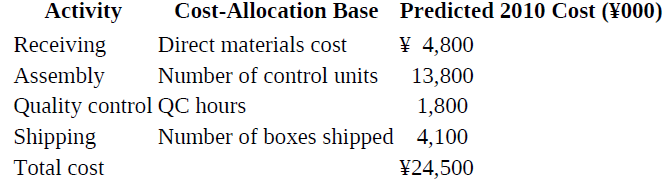

After Ms. Yamamoto attended the seminar, she suggested that Watanabe experiment with an ABC system in the automotive controls department. She identified four main activities that cause indirect production costs in the department and selected a cost driver to use as a cost-allocation base for each activity as follows:

In 2010 the automotive controls department expects to produce 92,000 control units, use 600 quality control hours, and ship 8,200 boxes.

1. Explain how Watanabe Inc. allocates its indirect production costs using its traditional cost system. Include a computation of the allocation rate used.

2. Explain how Watanabe Inc. would allocate indirect production costs under Ms. Yamamoto’s proposed ABC system. Include a computation of all the allocation rates used.

3. Suppose Watanabe prices its products at 30 percent above total production cost. An order came in from Nissan for 5,000 control units. Yamamoto estimates that filling the order will require ¥8,000,000 of direct materials cost and ¥2,000,000 of direct labour. It will require 50 hours of QC inspection time and will be shipped in 600 boxes.

a. Compute the price charged for the 5,000 control units if Watanabe uses its traditional cost accounting system.

b. Compute the price charged for the 5,000 control units if Watanabe uses the ABC system proposed by Ms. Yamamoto.

4. Explain why costs are different in the two costing systems. Include an indication of which costs you think are most accurate, and explain why.

Step by Step Answer:

Management Accounting

ISBN: 978-0132570848

6th Canadian edition

Authors: Charles T. Horngren, Gary L. Sundem, William O. Stratton, Phillip Beaulieu