Milt Pearson, the president of Supergrip Corporation Limited (SCL), is concerned with the results achieved by SCL

Question:

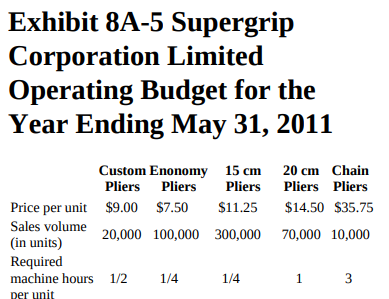

Milt Pearson, the president of Supergrip Corporation Limited (SCL), is concerned with the results achieved by SCL for the fiscal year ended May 31, 2010, and has called a meeting of the Executive Committee. Present are the vice president of manufacturing, the vice president of sales, and Diane Crombie, CMA, who has just been hired as the corporate controller. SCL is a large centralized manufacturer of pliers. The pliers are cast, finished, and assembled in the company’s plant and are distributed to wholesalers for sale to retail outlets, automotive service shops, and general manufacturing companies. Included in the product line are four different grades and sizes of locking pliers and a special chain plier that is used for many purposes, including removing oil filters from engines.

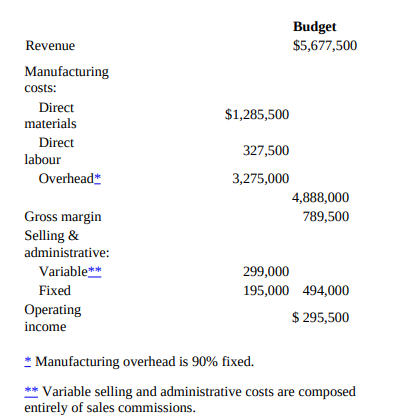

President: “I’m not very happy with our 2010 results, and the budget for next year doesn’t show any improvement. The trend of declining profits that we’ve experienced over the past few years must be reversed. Diane, your first task was to prepare an analysis of last year’s results. Please summarize the results of your analysis.

” Controller: “My analysis indicated that actual manufacturing costs were equal to standard last year and that the main problems were with the selling prices and mix of sales. I’ll need more information before I can identify the cause of each problem.

” President: “Can either of you provide the information Diane requires?

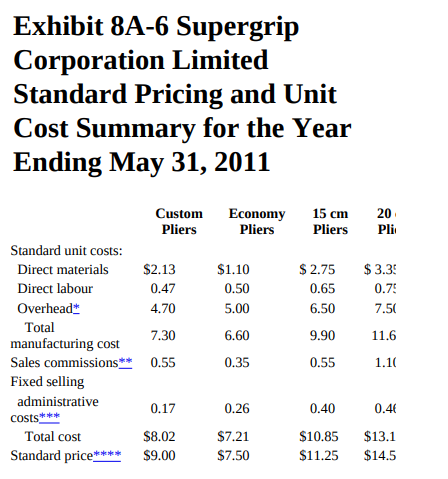

VP Sales: “Yes. Although the products with the smallest market volumes are selling well, we’ve been losing ground on the products with the higher market volumes. This is mainly because we can’t match the prices of our two main competitors. Halfway through last year, we had to drop our prices for both the economy and 15-centimetre pliers just to keep our largest customers. We’ll have to do the same this year or risk losing 20 percent of our sales volume for these two products. For Diane’s benefit, I’ve brought along the standard pricing and cost report that Joe, Diane’s predecessor, and I had put together when planning for this year’s budget. [See Exhibit 8A-6.] This report explains our standard pricing policy.”

Controller: “From what I’ve seen of Joe’s work, I’m sure the standard costs used in the budget and costing reports are accurate. I’ll need some additional data to properly assess the situation.”

President: “What can be done to achieve at least a 10 percent profit margin?”

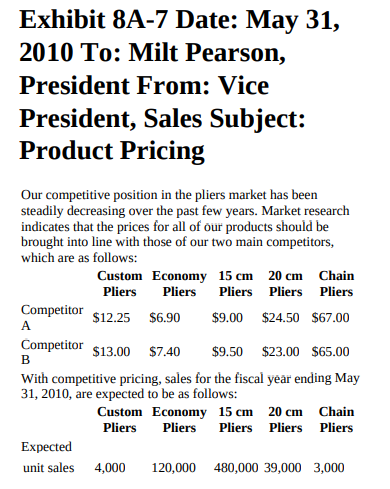

VP Sales: “The budgeted sales volumes are the best we can expect using the budgeted sales prices. Our market research indicates that we should bring our prices more in line with our two main competitors. Here are the projected sales volumes which we can expect to achieve if we match our competitor’s prices.” [See Exhibit 8A-7.]

President: “But we’ll lose money on the 15-centimetre pliers and may only break even on the economy pliers unless we cut down the production costs.”

VP Manufacturing: “I don’t think there’s any way that we can reduce costs further. We’ve about finished automating the production end of operations. We acquired a lot of computer-aided manufacturing equipment which has virtually eliminated wastage and spoiled units. Direct labour costs have been cut by 20 percent per year for the last five years. We’ve been working at our capacity of approximately 200,000 machine-hours, and costs have been right on target. Scheduling of work on machines is becoming increasingly difficult because of the uncertainty in sales volume. We’ve just managed to keep up with the sales orders, but with an increase in sales, we’ll end up with back orders.”

* Manufacturing overhead is allocated to products using the following formula: budgetedoverhead$budgeteddirectlabour$×actualdirectlabour$ = $3,275,000/$327,500 × actual direct labour $ = 10 times direct labour $

Ninety percent of total overhead is composed of depreciation, fixed productionrelated salaries, and other fixed manufacturing costs.

** These unit costs represent flat commission amounts per unit for each product, which were negotiated with the salespeople two years ago.

*** Fixed selling and administrative costs are allocated to products using the following formula: administrativecostsbudgetedtotalmanufacturingcosts×totalproductmanufacturing = $195,000/$4,888,000 × total product manufacturing cost

= 0.04 times total product manufacturing cost

**** Normally, standard selling prices are determined by multiplying total cost by 1.1 and rounding up to the nearest quarter (i.e., $.25). Due to current market conditions, the standard prices for economy and 15 cm pliers have been adjusted downward.

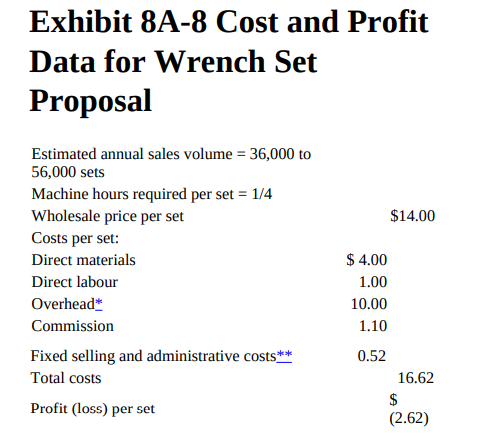

VP Sales: “There is something else we may want to look at. I met with my senior salespeople and they suggested that we introduce a set of high-quality wrenches to the product line. They say the wrenches will make money, but cost and profit projections don’t look very good.” [See Exhibit 8A-8.]

VP Manufacturing: “Milt, in order to help solve our capacity problems, especially if the wrench set is added to the product line, my staff has made a proposal to lease additional casting machinery. The addition of this new machinery will increase the overall production capacity by 5,000 machine-hours per year and it is expected that there will be no change in variable production costs per unit. The net fixed cost to lease this machinery will be $60,000 per year.

” President: “Diane, please analyze our situation and report back to me next week.”

* Overhead costs=10×Estimated direct labout costs=10× $1=$100

** The only increase in annual fixed selling and administrative costs would be $18,550 for advertising. The cost per set was calculated as follows: advertising/minimum sales volume = $18,550/36,000 sets = $0.52 per set Fixed selling and administrative costs** 0.52 Total costs 16.62 Profit (loss) per set $ (2.62)

After the meeting, Diane returned to her office and determined that she would have to consider at least the following six issues:

1. cost allocation

2. product prices

3. the proposal to introduce a set of wrenches to the product line

4. the option to increase capacity by leasing machinery

5. production mix planning 6. management reporting system

Required

Assuming the role of Diane Crombie, prepare a report to Milt Pearson. Include in the report your analysis of and recommendations on the six issues above as well as any other issues you feel should be addressed. Also, include a projected income statement for the fiscal year ending May 31, 2011, which reflects the effects of your recommendations.

Step by Step Answer:

Management Accounting

ISBN: 978-0132570848

6th Canadian edition

Authors: Charles T. Horngren, Gary L. Sundem, William O. Stratton, Phillip Beaulieu