Question: Smith Ltd has decided to increase its productive capacity to meet an anticipated increase in demand for its products. The extent of this increase in

Smith Ltd has decided to increase its productive capacity to meet an anticipated increase in demand for its products. The extent of this increase in capacity has still to be determined, and a management meeting has been called to decide which of the following two mutually exclusive proposals - A or B - should be undertaken.

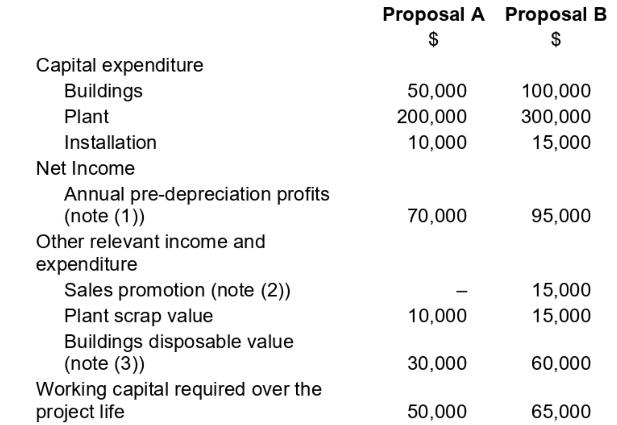

The following information is available:

(1) The investment life is ten years.

(2) An exceptional amount of expenditure on sales promotion of $\$ 15,000$ will have to be spent in year 2 of proposal $B$. This has not been taken into account in calculating pre-depreciation profits.

(3) It is the intention to dispose of the buildings in ten years' time.

Using an $8 \%$ discount rate, calculate which of the two alternatives should be chosen.

Capital expenditure Buildings Plant Proposal A Proposal B $ $ 50,000 100,000 200,000 300,000 Installation 10,000 15,000 Net Income Annual pre-depreciation profits (note (1)) 70,000 95,000 Other relevant income and expenditure Sales promotion (note (2)) 15,000 Plant scrap value 10,000 15,000 Buildings disposable value (note (3)) 30,000 60,000 Working capital required over the project life 50,000 65,000

Step by Step Solution

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts