Southwestern Bank provides house loans for the region. Customers seeking a loan to buy a house initially

Question:

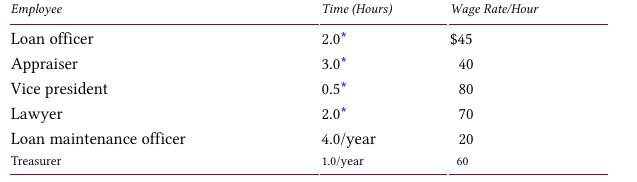

Southwestern Bank provides house loans for the region. Customers seeking a loan to buy a house initially talk to a loan officer who gathers the appropriate information about the customers. The bank then hires a local appraiser to evaluate the home being purchased. The customer and appraisal information is then sent to the vice president of the bank to make the final decision on the home loan. If both the bank and customer agree on the conditions of the home loan, the bank sends its lawyer to the closing on the sale of the house with the appropriate documents. Once the bank loan is granted, a loan maintenance officer receives and records the monthly payments and sends the checks on to the treasurer, where they are deposited in the bank. The average time spent on a house loan by each of these employees and their hourly wages are:

Only in the first year of the loan

a. A decision to make the loan is made by the vice president. The loan officer and appraisal work has been completed already. What is the cost of a loan application that has been turned down?

b. If the loan is accepted, the remaining labor costs are incurred. What is the average direct labor cost of an accepted loan the first year?

c. What is the average direct labor cost of an accepted loan the second year?

Step by Step Answer:

Management Accounting In A Dynamic Environment

ISBN: 9780415839020

1st Edition

Authors: Cheryl S McWatters, Jerold L Zimmerman