The Eastclock Corporation (EC) manufactures timing devices that are used in industrial settings. Recently, profits have fallen,

Question:

The Eastclock Corporation (EC) manufactures timing devices that are used in industrial settings. Recently, profits have fallen, and management is seeking your advice as an outside consultant on changes that should be made.

During its 60-year history, EC has developed a strong and loyal customer base due largely to its reputation for quality timing devices. Significant investments in new computer-designed products and automated tooling have reduced operating costs and enabled EC to maintain its competitive edge. However, during the past three years, sales of its two major products have declined or have become stagnant. Had it not been for increased sales of its “custom” timing devices, EC would have incurred losses.

EC’s basic product line consists of the “standard” model and the “deluxe” model. The “standard” model requires $8 in direct materials and requires one hour of direct labour (0.4 hours of machining and 0.6 hours of assembly). The “deluxe” model requires an additional $4 worth of direct materials and requires a total of 1.5 hours of direct labour (0.5 hours of machining and one hour of assembly). The standard labour rate is $12 per hour.

In addition to the basic product line, the company manufactures custom timing devices. The average direct material and direct labour costs for a custom timing device are approximately $20 and $30 per unit, respectively. Each custom unit requires 2.5 hours of direct labour (0.8 hours of machining and 1.7 hours of assembly).

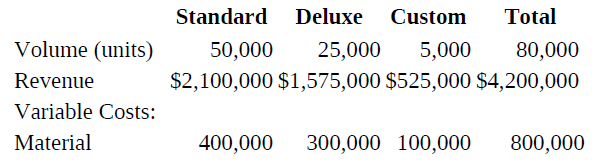

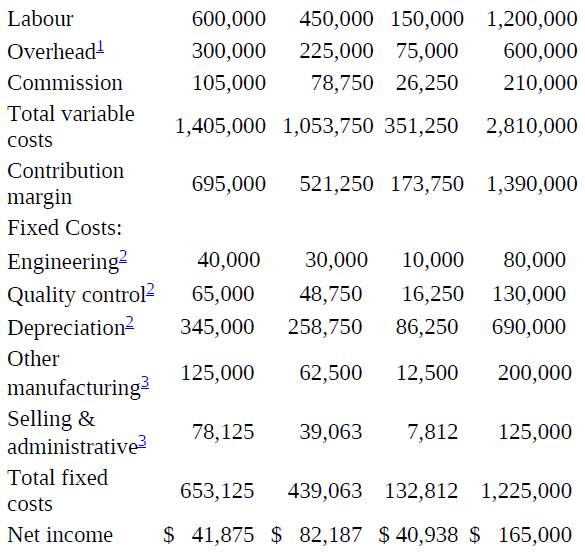

Indirect manufacturing overhead costs are significant and totalled $1,700,000 in 2012. Variable overhead costs include small tools, lubricants, and indirect labour charges. Fixed overhead costs consist of the following: Engineering (design and estimating) $80,000; Quality Control (setup time and materials) $130,000; Depreciation on buildings and equipment $690,000; and other costs such as property taxes, maintenance, and supervisory salaries of $200,000. A complete income statement for 2012 is shown in Exhibit 5B-1 of this case.

As an outside consultant, you begin your analysis of the current situation by meeting with the controller, Jack Downie, in early January 2013. Jack, who has no formal training in accounting, is nonetheless proud of the internal accounting system and the changes that he has introduced during the past five years. “We’ve spent a lot of time converting to the contribution format. We’ve carefully analyzed the variable and fixed costs using our little microcomputer and some pretty powerful software.

I’m really confident that we’ve got an accurate handle on how costs behave as volume rises and falls in the various product lines. Because the volume of ‘custom’ orders has increased during the past three years, we have charged relatively more overhead to this line on each of the semi-annual statements. The 5 percent sales commission is tacked on to the analysis of each of the product lines and we charge out the fixed selling and administrative expenses based on the volume of orders processed.”

Exhibits 5B-1

1. It has been reliably determined that variable overhead is a function of direct labour dollars.

2. Fixed manufacturing overhead (Engineering, Quality Control, and Depreciation) is allocated to products based on their relative proportion of total direct labour dollars.

3. Other fixed manufacturing overhead and fixed selling and administrative expenses are allocated to products based on the relative volume of units sold.

Further discussions took place with the production people, including representatives of engineering, quality control, and the machining and assembly departments. Interviews also took place with representatives of the marketing and administrative departments. A summary of the highlights of these discussions follows.

Karl Bechtold (Engineering Department): “Our new computer assisted design system has really changed the way we do things around here. When an order comes in, it is tagged as being either standard, deluxe, or custom. I’d guess that 75 percent of our time is spent on the custom orders as they usually require significant adaptations. I’ve pointed this out to the accounting people on several occasions, but they seem pretty tied up lately with their new computer. The standard model requires our attention from time to time but I’d guess that it’s only about 5 percent. Revisions to the deluxe model are a little more complicated and take up the remainder of our efforts during the average month. If we were to return to more normal levels of production for the three products, I’d guess that we would spend about half of our time on the custom orders and split the remaining hours between the other two lines.”

Harvey Ramsoomair (Quality Control): “Nothing leaves this plant that isn’t strictly to our customers’ specifications. It may not be what they wanted but it’s guaranteed to be what they ordered. This sort of quality assurance is only possible by carefully monitoring the quality of our raw materials and the production process. We check the output of the work centres when they begin each job and monitor outputs randomly. Given that the standard and deluxe models are produced in large batches, I’d guess that they each currently take about 20 percent of our time on a monthly basis. I couldn’t be much more accurate than that because we only get official information on production volumes twice a year. If the volume of standard sales returned to its normal level, I’m sure that the amount of time for the two basic products would increase to about 30 percent per product. Whatever happens, the remaining time goes to the custom work, which really keeps us on our toes.”

Fran Sprocket (Supervisor Machining & Assembly): “This new computer-aided manufacturing equipment has really changed our manufacturing procedures. I can remember just a few years ago how we had to carefully monitor each operation. Now, once we get the thing set up, all we have to do is monitor the output. This machinery is very expensive. The annual depreciation on the machinery is $230,000 for each of the product lines. I’ve never understood why the accounting system charges so little depreciation to the custom line given that we invested a lot in the machinery to accommodate these special orders for customers. The costs that are labelled as ‘other manufacturing’ in the accounting reports seem to relate mostly to the volume of goods produced and sold. My biggest problem is scheduling the assembling hours. The physical layout of the plant restricts the amount of assembly space and, therefore, the number of hours that I can schedule. The maximum number of assembly hours is 70,000 and nothing can be done to increase this in the next 12 months.”

Steve Wong (Marketing): “I don’t feel that there is any problem with the costing system as far as marketing expenses are concerned. The amount of time, energy, and expense devoted to each of the product lines seems to depend on the volume of orders sold. The big problem I hear about from the salespeople centres around our prices. We’re running about $5 above our competitors on the standard model and this is really cutting in to our volume. If we could justify a more competitive price, I expect sales would jump to a more normal level of 74,000 units per year. We currently base all of our prices on a 50 percent markup over variable costs and then round off to the nearest dollar.

“My people are glad to see those custom orders rolling in. It’s hard to find out what our competitors are charging for similar work but there is some evidence to suggest that our prices are way out of line compared to our competition. The strategy of the company is to market the standard and deluxe models and offer the custom model as a service to regular customers at a premium price. As a result, we would normally sell about 1,000 custom units per year, which is the level we operated at several years ago. With respect to the deluxe model, I feel that the current price is more or less correct and, thus, we expect that volume will remain at current levels for the foreseeable future.”

Toni Anderson (Vice President): “We’ve got to turn this situation around or we’ll have to sell out. The boss says he’s been getting some pretty attractive offers from some American tool-and-die firms. I’d hate to see us sell out without a fight because I think we’ve got a responsibility to our employees—some of whom have been with us since high school. The bottom line is each product should cover its own costs and earn at least a profit margin of 10 percent before taxes this year.”

Required

Assume the role of the outside consultant. Prepare a report addressed to the management of Eastclock Corporation that clearly identifies and analyzes the issues it faces, and make specific recommendations for improvement. Also include a pro forma income statement for 2013 that incorporates your recommendations.

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Management Accounting

ISBN: 978-0132570848

6th Canadian edition

Authors: Charles T. Horngren, Gary L. Sundem, William O. Stratton, Phillip Beaulieu