The South African company DT Constructers has been carrying out work on a number of building contracts

Question:

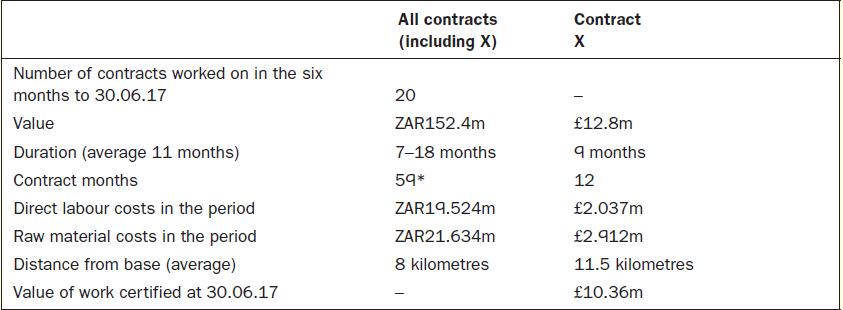

The South African company DT Constructers has been carrying out work on a number of building contracts including contract X over the six-month period ended 30 June 2017. The following information is available:

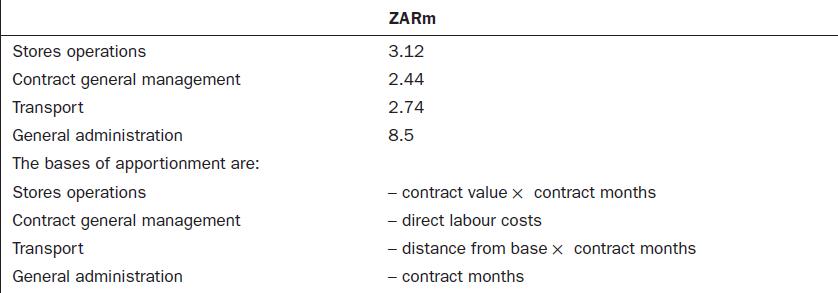

The South African currency is the rand, denoted as ZAR. Contract X commenced on 1 September 2016. As at 30 November 2016 cumulative costs on the contract, held in work-in-progress, totalled £2.126m (including overheads). DT Constructers predicts that further costs after 30 June 2017 to complete Contract X on time including overheads will not exceed ZAR1.874m. Overheads incurred over the six-month period to 30 June 2017, which are to be apportioned to individual contracts, are:

Required

1. (a) Allocate overheads to Contract X for the six-month period to 30 June 2017 (to the nearest ZAR000 for each overhead item).

(b) Determine the expected profit/loss on Contract X, and the amount of profit/loss on the contract that you recommend be included in the accounts of the company for the six-month period to 30 June 2017.

2. DT Constructers is introducing a service costing system into its stores operations department. Outline the key factors to consider when introducing the service costing system.

Step by Step Answer:

Management Accounting

ISBN: 9780077185534

6th Edition

Authors: Will Seal, Carsten Rohde, Ray Garrison, Eric Noreen