The Wittred division of Melbourne Sports Company manufactures boomerangs, which are sold to wholesalers and retailers. The

Question:

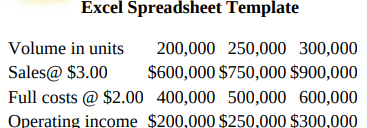

The Wittred division of Melbourne Sports Company manufactures boomerangs, which are sold to wholesalers and retailers. The division manager has set a target of 250,000 boomerangs for next month’s production and sales and developed an accurate budget for that level of sales. The manager has also prepared an analysis of the effects on operating income of deviations from the target:

The costs have the following characteristics. Variable manufacturing costs are $0.80 per boomerang; variable selling costs are $0.60 per boomerang. Fixed manufacturing costs per month are $125,000; fixed selling and administrative costs per month are $25,000.

1. Prepare a correct analysis of the changes in volume on operating income. Prepare a tabulated set of income statements at levels of 200,000, 250,000, and 300,000 boomerangs. Also show percentages of operating income in relation to sales.

2. Compare your tabulation with the manager’s tabulation. Why is the manager’s tabulation incorrect?

Step by Step Answer:

Management Accounting

ISBN: 978-0132570848

6th Canadian edition

Authors: Charles T. Horngren, Gary L. Sundem, William O. Stratton, Phillip Beaulieu