Unless otherwise indicated, each of the following questions is independent. In all cases, show computations to support

Question:

Unless otherwise indicated, each of the following questions is independent. In all cases, show computations to support your answer.

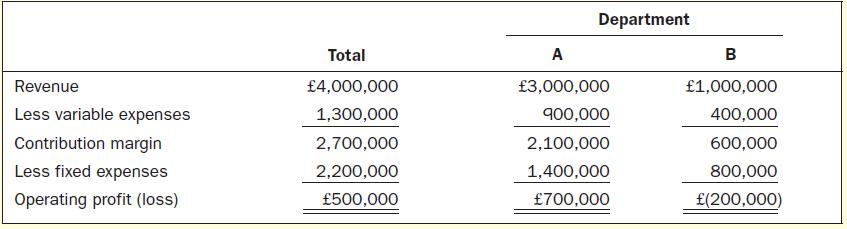

1. A merchandising company has two departments, A and B. A recent monthly statement of profit or loss for the company follows:

A study indicates that £340,000 of the fixed expenses being charged to Department B are sunk costs or allocated costs that will continue even if B is dropped. In addition, the elimination of Department B will result in a 10% decrease in the sales of Department A. If Department B is dropped, what will be the effect on the net operating profit of the company as a whole?

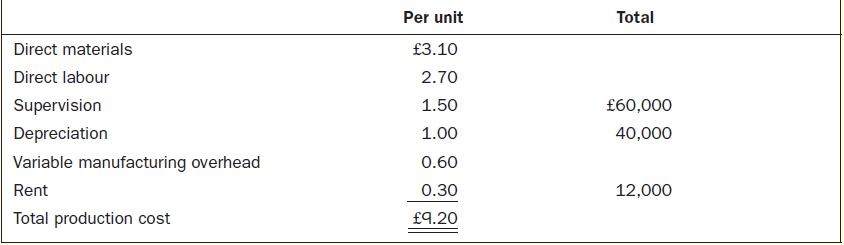

2. For many years Futura Company has purchased the starters that it installs in its standard line of farm tractors. Due to a reduction in output of certain of its products, the company has idle capacity that could be used for producing the starters. The chief engineer has recommended against this move, however, pointing out that the cost to produce the starters would be greater than the current £8.40 per unit purchase price:

A supervisor would have to be hired to oversee production of the starters. However, the company has sufficient idle tools and machinery that no new equipment would have to be purchased. The rent charge above is based on space utilized in the plant. The total rent on the plant is £80,000 per period. Depreciation is due to obsolescence rather than wear and tear. Prepare computations to show the financial advantage or disadvantage per period of making the starters.

3. Wexpro Ltd produces several products from processing 1 tonne of clypton, a rare mineral. Material and processing costs total £60,000 per tonne, a quarter of which is allocated to product X. Seven thousand units of product X are produced from each tonne of clypton. The units can either be sold at the split-off point for £9 each, or processed further at a total cost of £9,500 and then sold for £12 each. Should product X be processed further or sold at the split-off point?

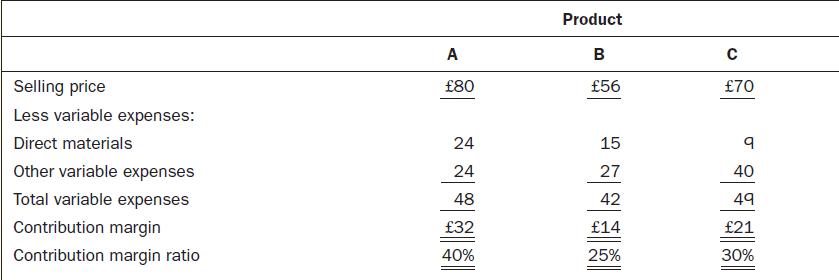

4. Benoit Company produces three products, A, B and C. Data concerning the three products follows (per unit):

Demand for the company’s products is very strong, with far more orders each month than the company has raw materials available to produce. The same material is used in each product. The material costs £3 per kilo, with a maximum of 5,000 kilos available each month. Which orders would you advise the company to accept first, those for A, for B or for C? Which orders second? Third?

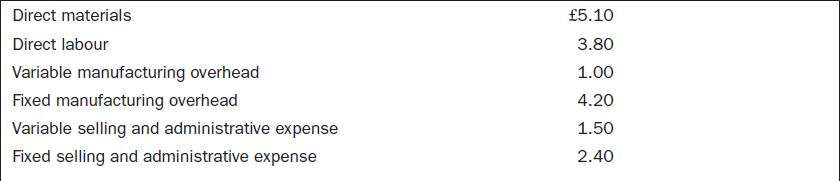

5. Delta Company produces a single product. The cost of producing and selling a single unit of this product at the company’s normal activity level of 60,000 units per year is:

The normal selling price is £21 per unit. The company’s capacity is 75,000 units per year. An order has been received from a mail-order house for 15,000 units at a special price of £14 per unit. This order would not affect regular sales. If the order is accepted, by how much will annual profits be increased or decreased? (The order will not change the company’s total fixed costs.)

6. Refer to the data in Question 5 above. Assume the company has 1,000 units of this product left over from last year that are vastly inferior to the current model. The units must be sold through regular channels at reduced prices. What unit cost figure is relevant for establishing a minimum selling price for these units? Explain.

Data from Question 5

‘Sunk costs are easy to spot – they’re simply the fixed costs associated with a decision.’ Do you agree? Explain.

Step by Step Answer:

Management Accounting

ISBN: 9780077185534

6th Edition

Authors: Will Seal, Carsten Rohde, Ray Garrison, Eric Noreen