Wayne Andrews, the president and major shareholder of Walnut Furniture Limited (Walnut), was reviewing the 2012 and

Question:

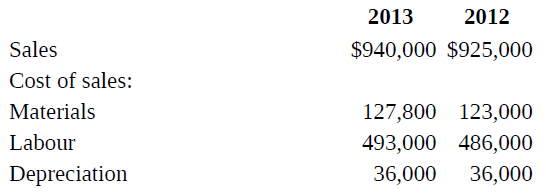

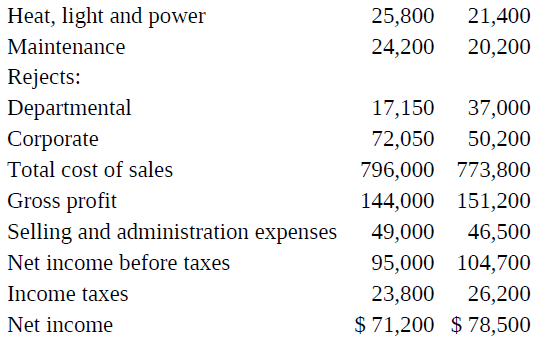

Wayne Andrews, the president and major shareholder of Walnut Furniture Limited (Walnut), was reviewing the 2012 and 2013 comparative income statements (Exhibit 6A-1) and was wondering why, despite all his efforts, profits had not improved. Walnut manufactured and installed fitted furniture and fixtures in new buildings on a contract basis.

Walnut’s operations were organized into three departments: fabricating, finishing, and installing. Each department was treated as a cost centre. The total hourly operating costs, including labour of each department, were determined each month and charged to each job on the basis of the hours it was in process in each department (Exhibit 6A-2). The departmental operating costs per hour were compared to those of the previous year for cost control. Wayne attempted to keep his workers employed on a steady full-time basis, which sometimes required workers to be transferred from one department to another. Therefore, he regarded labour costs as being fixed.

Wayne has been very satisfied with the cost accounting system since its introduction, and felt it gave him good cost control and a basis for submitting bids for contracts. However, Wayne had two recurring problems: winning contracts to fill capacity, and controlling rejects. Bids were based on estimates of processing time required in each department costed at the most recent month’s departmental processing costs per hour. Wayne and the estimator discussed how much should be added for profit for each bid; normally, the target profit rate of 10 percent of total estimated costs was used as a starting point in deciding the final bid amount to submit.

Walnut competed for contracts in two distinct market segments, both involving the manufacture of furniture and fixtures in the plant, and then installation on site. The first segment involved large contracts for standard units to be installed in multiunit apartment buildings and franchised fast-food outlets. Wayne devoted a great deal of time pursuing this type of contract since the large quantities involved would fill capacity. He had succeeded in increasing the number of bids won in this segment, but not to the extent he had hoped to achieve. The second segment involved smaller contracts for luxury apartments requiring high-quality work and materials, often customized for each apartment. Most of Walnut’s contracts had been won in the second segment. Wayne had asked his estimator to prepare a schedule of data on two recent bids (Exhibit 6A-3) and a summary of bids submitted and won in 2013 and 2012 (Exhibit 6A-4).

Exhibit 6A-1

Required

As the management-accounting consultant engaged by Wayne Andrews, prepare the requested report on Walnut’s operations and problems.

Step by Step Answer:

Management Accounting

ISBN: 978-0132570848

6th Canadian edition

Authors: Charles T. Horngren, Gary L. Sundem, William O. Stratton, Phillip Beaulieu