Corfe Co. is a business which manufactures laptop batteries and it has developed a new battery which

Question:

Corfe Co. is a business which manufactures laptop batteries and it has developed a new battery which has a longer usage time than batteries currently available in laptops. The selling price of the battery is forecast to be $45.

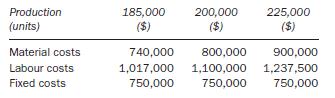

The maximum production capacity of Corfe Co. is 262,000 units. The company’s management accountant is currently preparing an annual flexible budget and has collected the following information so far:

In addition to the above costs, the management accountant estimates that for each increment of 50,000 units produced, one supervisor will need to be employed. A supervisor’s annual salary is $35,000.

The production manager does not understand why the flexible budgets have been produced as he has always used a fixed budget previously.

(a) Assuming the budgeted figures are correct, what would the flexed total production be if production is 80 per cent of maximum capacity?

(i) $2,735,000

(ii) $2,770,000

(iii) $2,885,000

(iv) $2,920,000

(b) The management accountant has said that a machine maintenance cost was not included in the flexible budget but needs to be taken into account.

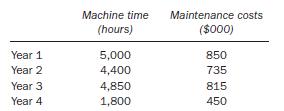

The new battery will be manufactured on a machine currently owned by Corfe Co. which was previously used for a product which has now been discontinued. The management accountant estimates that every 1,000 units will take 14 hours to produce. The annual machine hours and maintenance costs for the machine for the last four years have been as follows:

What is the estimated maintenance cost if production of the battery is 80 per cent of maximum capacity (to the nearest $000)?

(i) $575,000

(ii) $593,000

(iii) $500,000

(iv) $735,000

(c) In the first month of production of the new battery, actual sales were 18,000 units and the sales revenue achieved was $702,000. The budget sales units were 17,300. Based on this information, which of the following statements is true?

(i) When the budget is flexed, the sales variance will include both the sales volume and price variances.

(ii) When the budget is flexed, the sales variance will only include the sales volume variance.

(iii) When the budget is flexed, the sales variance will only include the sales price variance.

(iv) When the budget is flexed, the sales variance will include the sales mix and quantity variances and the sales price variance.

(d) Which of the following statements relating to the preparation of a flexible budget for the new battery are true?

1. The budget could be time-consuming to produce as splitting out semi-variable costs may not be straightforward.

2. The range of output over which assumptions about how costs will behave could be difficult to determine.

3. The flexible budget will give managers more opportunity to include budgetary slack than a fixed budget.

4. The budget will encourage all activities and their value to the organization to be reviewed and assessed.

(i) 1 and 2 only

(ii) 1, 2 and 3

(iii) 1 and 4

(iv) 2, 3 and 4

(e) The management accountant intends to use a spreadsheet for the flexible budget in order to Analyse performance of the new battery. Which of the

following statements are benefits regarding the use of spreadsheets for budgeting?

1. The user can change input variables and a new version of the budget can quickly be produced.

2. Errors in a formula can be easily traced and data can be difficult to corrupt in a spreadsheet.

3. A spreadsheet can take account of qualitative factors to allow decisions to be fully evaluated.

4. Managers can carry out sensitivity analysis more easily on a budget model which is held in a spreadsheet.

(i) 1, 3 and 4

(ii) 1, 2 and 4

(iii) 1 and 4 only

(iv) 2 and 3

Step by Step Answer: