Jenson, Lewis and Webb (JLW) manufactures tubes of acrylic paint for sale to artists and craft shops

Question:

Jenson, Lewis and Webb (JLW) manufactures tubes of acrylic paint for sale to artists and craft shops in Kayland and Seeland. JLW has two divisions, Domestic division and Export division, both based in Kayland. All costs are incurred in Kayland Dollars ($KL). Domestic division is an investment centre and sells only to customers in Kayland. Export division is a profit centre and exports all its products to Seeland, where customers are invoiced in Seeland Pounds (ESL), at prices fixed at the start of the year. The objective of JLW is to maximize shareholder wealth.

At the beginning of the year ended 31 December 20X9, the head office at JLW purchased new production machinery for Export division for $KL 2.5m, which significantly increased the production efficiency of the division. Managers at Domestic division were considering purchasing a similar machine but decided to delay the purchase until the beginning of the following financial year. On 30 June 20X9 the $KL weakened by 15 per cent against the ESL, after which the exchange rate between the two currencies has remained unchanged.

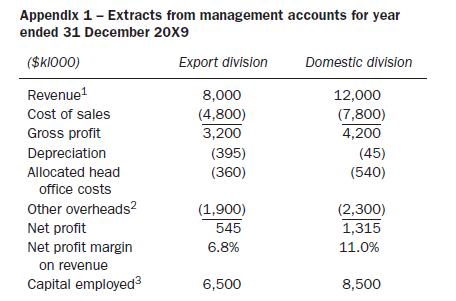

The managers of the two divisions are currently appraised on the performance of their own divisions and are awarded a large bonus if the net profit margin of their division exceeds 8 per cent for the year. Extracts from the management accounts for the year ended 31 December 20X9 for both divisions are given in

Appendix 1. On being told that she would not be receiving am bonus for the financial year, the manager of Export division has commented that she has had difficulty in understanding the bonus calculations for her division as it is not based on traceable profit, which would consider only items which relate directly to the division. She also does not believe it is appropriate that the net profit margin used to appraise her performance is the same as ‘that which is used to evaluate the performance of Export division itself’. She has asked for a meeting with the directors to discuss this further.

JLW’s directors intend to award divisional managers’ bonuses on the basis of net profit margin achieved in 20X9 as planned, but they have asked you as a performance management consultant for your advice on the comments of the Export division manager in advance of their meeting with her. One director has also suggested that, in future, economic value added (EVA(TM)) may be a good way to evaluate and compare the performance of the two divisions. You are asked for your advice on this too, but you have been specifically asked not to attempt a calculation of EVA(TM).

Required:

(a) Evaluate the comments of the Export division manager that the net profit margin used to appraise her own performance should be different from that used to appraise the performance of Export division itself.

(b) Recommend, using appropriate calculations, whether the manager of Export division should receive her bonus for the year.

(c) Advise whether the use of economic value added (EVA(TM)) is an appropriate measure of performance of the two divisions. You are not required to perform an EVA(TM) calculation.

1Revenue accrues evenly over the financial year.

2 Other overheads for Domestic division include the creation of a bad debt provision equivalent to $KL75,000 for a wholesale customer who had financial difficulties during the year, and $KL90,000 for advertising a new range of paints launched at the end of the year.

3 JLW is financed in equal proportions by debt and equity. The cost of equity is 8 per cent and the after tax cost of debt is 5 percent.

Step by Step Answer: