Sports Co. is a large manufacturing company specializing in the manufacture of a wide range of sports

Question:

Sports Co. is a large manufacturing company specializing in the manufacture of a wide range of sports clothing and equipment. The company has two divisions: Clothing (Division C) and Equipment (Division E). Each division operates with little intervention from Head Office and divisional managers have autonomy to make decisions about long-term investments.

Sports Co. measures the performance of its divisions using return on investment (ROI), calculated using controllable profit and average divisional net assets. The target ROI for each of the divisions is 18 per cent. If the divisions meet or exceed this target, the divisional managers receive a bonus.

Last year, an investment which was expected to meet the target ROI was rejected by one of the divisional managers, because it would have reduced the division’s overall ROI. Consequently, Sports Co. is considering the introduction of a new performance measure, residual income (RI), in order to discourage this dysfunctional behaviour in the future. Like ROI, this would be calculated using controllable profit and average divisional net assets.

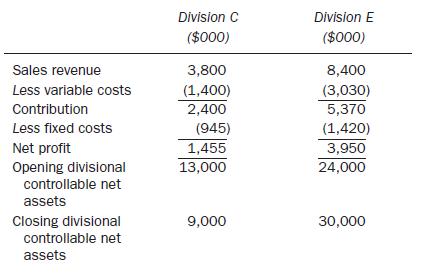

The draft operating statement for the year, prepared by the company’s trainee accountant is shown below:

Notes

1. Included in the fixed costs are depreciation costs of $165,000 and $460,000 for Divisions C and E respectively. 30 per cent of the depreciation costs in each division relates to assets controlled but not owned by Head Office. Division E invested $2m in plant and machinery at the beginning of the year, which is included in the net assets figures above, and uses the reducing balance method to depreciate assets. Division C, which uses the straight-line method, made no significant additions to non-current assets. It is the policy of both divisions to charge the full year’s depreciation in the year of acquisition.

2. Head Office recharges all of its costs to the two divisions. These have been included in the fixed costs and amount to $620,000 for Division C and $700,000 for Division E.

Required:

(a) (i) Calculate the return on investment for each of the two divisions of Sports Co.

(ii) Discuss the performance of the two divisions for the year including the main reasons why their ROI results differ from each other. Explain the impact the difference in ROI could have on the behaviour of the manager of the worst performing division.

(b) (i) Calculate the residual income (RI) for each of the two divisions of Sports Co. and briefly comment on the results of this performance measure.

(ii) Explain the advantages and disadvantages of using residual income (RI) to measure divisional performance.

Step by Step Answer: