Sweet Cicely (SC) manufactures sweets and confectionery and has delivered stable but modest increases to the shareholder

Question:

Sweet Cicely (SC) manufactures sweets and confectionery and has delivered stable but modest increases to the shareholder wealth for many years. Following a change in ownership, the new shareholders are keen to increase the long-term performance of the business and are prepared to accept a high level of risk to achieve this.

SC is considering setting up a factory to manufacture chocolate bars. There are three options (1, 2 and 3) for the size and output capacity of the new chocolate factory. SC must choose a size most suited to the expected demand for its products. As well as the impact of the quality, branding and pricing of its products, demand for SC chocolate bars will be influenced by external factors such as consumer tastes for chocolate over other sweets, and even the suggested health benefits of certain types of chocolate.

A high-cost ingredient in chocolate bars is cocoa, a commodity traded on international markets. The market price of cocoa fluctuates with worldwide demand. Due to economic growth, chocolate consumption is rising in many countries, where it was once considered a luxury. In some countries, however, governments are considering introducing additional taxes on products containing sugar in order to reduce the consumption of chocolate and confectionery products. Being derived from an agricultural crop, the availability and price of cocoa is also influenced by climatic conditions, soil erosion and disease.

Conflicts and political instability in cocoa growing regions can also restrict its availability. Recent technological advances in the production of cocoa, such as the use of genetically modified crops, promise higher yields from cocoa plants in the near future.

You have been asked to help SC choose one of the three options for the new chocolate factory. One board member told you: ‘The board proposed expanding into cake manufacturing several years ago. With hindsight, our planning on that proposal was poor. We sold only slightly fewer cakes than expected but

hadn’t realised how sensitive our operating profit would be to a small change in demand. The previous shareholders thought problems in the cake business would put their dividends at risk, so SC stopped manufacturing cakes, barely a year after it started. The board does not want to repeat these mistakes.

We want to minimize the opportunity cost of making the wrong decision about the size of the new chocolate factory.

Appendix 1 shows the net present values for the three options discounted at SC’s current cost of capital. Appendix 2 shows the expected operating profit generated by the three options in the first year of the project, according to the market price of cocoa, and assuming an annual demand of 70 million chocolate bars.

Required:

(a) Advise SC why decisions, such as what size of chocolate factory to build, must include consideration of risk and uncertainty, and evaluate the use of PEST analysis in managing the risk and uncertainty surrounding the project.

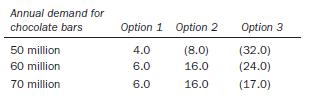

(b) Using the data in Appendix 1, explain which of the three options for the new chocolate factory would be preferred by the board and the new shareholders according to their respective risk appetites.

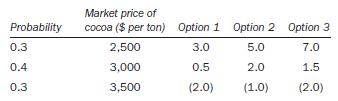

(c) Using the data in Appendix 2, recommend which of the three options for the new chocolate factory a risk neutral investor would choose, and explain any problems with the approach used to make the choice.

Appendix 1

Net present values for the three options discounted at SC’s current cost of capital ($m)

Appendix 2

Expected operating profit generated by the three options in the first year of the project, assuming an annual demand of 70 million chocolate bars ($m)

Step by Step Answer: