Audumla Oy began operations in 2022 and differs from Ginnungagap in only one respect: it has both

Question:

Audumla Oy began operations in 2022 and differs from Ginnungagap in only one respect: it has both variable and fixed manufacturing costs. Its variable manufacturing costs are €7 per tonne, and its fixed manufacturing costs are €140 000 per year. The denominator level is 20 000 tonnes per year.

Required 1 Using the same data as in Exercise 7.22 except for the change in manufacturing cost behaviour, prepare income statements with adjacent columns for 2022, 2023 and the two years together, under

(a) variable costing and

(b) absorption costing.

2 Why did Audumla have operating profit for the two-year period when Ginnungagap in Exercise 7.22 suffered an operating loss?

3 What value for stock would be shown in the balance sheet as at 31 December 2022 and 31 December 2023 under each method?

4 Assume that the performance of the top manager of the company is evaluated and rewarded largely on the basis of reported operating profit. Which costing method would the manager prefer? Why?

Exercise 7.22

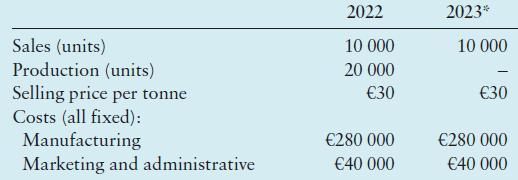

It is the end of 2023. Ginnungagap Oy began operations in January 2022. The company is so named because it has no variable costs. All its costs are fixed; they do not vary with output.

Ginnungagap is located on the bank of a river and has its own hydroelectric plant to supply power, light and heat. The company manufactures a synthetic fertiliser from air and river water and sells its product at a price that is not expected to change. It has a small staff of employees, all hired on a fixed annual salary. The output of the plant can be increased or decreased by adjusting a few dials on a control panel.

The following are data regarding the operations of Ginnungagap Oy:

Required

1 Prepare income statements with one column for 2022, one column for 2023 and one column for the two years together, using

(a) variable costing and

(b) absorption costing.

2 What is the breakeven point under

(a) variable costing and

(b) absorption costing?

3 What stock costs would be carried on the balance sheets at 31 December 2022 and 2023 under each method?

4 Assume that the performance of the top manager of the company is evaluated and rewarded largely on the basis of reported operating profit. Which costing method would the manager prefer? Why?

Step by Step Answer:

Management And Cost Accounting

ISBN: 9781292436029

8th Edition

Authors: Alnoor Bhimani, Srikant Datar, Charles Horngren, Madhav Rajan