McCarthy Potatoes processes potatoes into chips at its highly automated Longford plant. For many years, it processed

Question:

McCarthy Potatoes processes potatoes into chips at its highly automated Longford plant. For many years, it processed potatoes for only the retail consumer market where it had a superb reputation for quality. Recently, it started selling chips to the institutional market that includes hospitals, cafeterias and university halls of residence. Its penetration into the institutional market has been slower than predicted. McCarthy’s existing costing system has a single direct-cost category (direct materials, which are the raw potatoes) and a single indirect-cost pool (production support). Support costs are allocated on the basis of kilograms of chips processed. Support costs include packaging material. This year’s total actual costs for producing 1000,000 kg of chips (900,000 for the retail market and 100,000 for the institutional market) are:

Direct materials used ............................................ €150,000

Production support ................................................ €983,000

The existing costing system does not distinguish between chips produced for the retail or the institutional markets.

At the end of the year, McCarthy unsuccessfully bid for a large institutional contract. Its bid was reported to be 30% above the winning bid. This came as a shock as McCarthy included only a minimum profit margin on its bid. Moreover, the Longford plant was widely acknowledged as the most efficient in the industry.

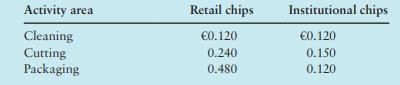

As part of its lost contract bid review process, McCarthy decided to explore several ways of refining its costing system. First, it identified that €188,000 of the €983,000 pertains to packaging materials that could be traced to individual jobs (€180,000 for retail and €8000 for institutional). These will now be classified as a direct material. The €150,000 of direct materials used were classified as €135,000 for retail and €15,000 for institutional. Second, it used activity-based costing (ABC) to examine how the two products (retail chips and institutional chips) used the support area differently. The finding was that three activity areas could be distinguished and that different usage occurred in two of these three areas. The indirect cost per kilogram of finished product at each activity area is as follows:

There was no opening or closing amount of any stock (materials, work in progress or finished goods).

Required

1. Using the current costing system, what is the cost per kilogram of chips produced by McCarthy?

2. Using the refined costing system, what is the cost per kilogram of (a) retail market chips, and (b) institutional market chips?

3. Comment on the cost differences shown between the two costing systems in requirements 1 and 2. How might McCarthy use the information in requirement 2 to make better decisions?

Step by Step Answer:

Management And Cost Accounting

ISBN: 9781292232669

7th Edition

Authors: Alnoor Bhimani, Srikant M. Datar, Charles T. Horngren, Madhav V. Rajan