Starkuchen GmbH has been in the food-processing business for three years. For its first two years (2017

Question:

Starkuchen GmbH has been in the food-processing business for three years. For its first two years (2017 and 2018), its sole product was raisin cake. All cakes were manufactured and packaged in 1 kg units. A normal costing system was used by Starkuchen. The two direct-cost categories were direct materials and direct manufacturing labour. The sole indirect manufacturing cost category – manufacturing overhead – was allocated to products using a units of production allocation base.

In its third year (2019) Starkuchen added a second product – layered carrot cake – that was packaged in 1 kg units. This product di ers from raisin cake in several ways:

● More expensive ingredients are used

● More direct manufacturing labour time is required

● More complex manufacturing is required.

In 2019, Starkuchen continued to use its existing costing system where a unit of production of either cake was weighted the same. Direct materials costs in 2019 were €0.60 per kg of raisin cake and €0.90 per kg of layered carrot cake. Direct manufacturing labour cost in 2019 was €0.14 per kg of raisin cake and €0.20 per kg of layered carrot cake.

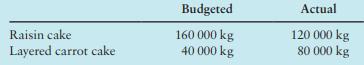

During 2019, Starkuchen sales people reported greater-than-expected sales of layered carrot cake and less-than-expected sales of raisin cake. The budgeted and actual sales volumes for 2019 were as follows:

The budgeted manufacturing overhead for 2019 was €210,800.

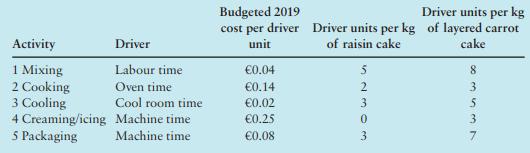

At the end of 2019, Wolfgang Iser, the accountant of Starkuchen, decided to investigate how use of an activity-based costing system would affect the product-cost numbers. After consultation with operating personnel, the single manufacturing overhead cost pool was subdivided into five activity areas. These activity areas, their driver, their 2019 budgeted rate and the driver units used per kilogram of each cake are as follows:

Required

1. Calculate the 2019 unit product cost of raisin cake and layered carrot cake with the normal costing system used in the 2017 to 2018 period.

2. Calculate the 2019 unit product cost per cake under the activity-based normal costing system.

3. Explain the differences in unit product costs calculated in requirements 1 and 2.

4. Describe three uses Starkuchen might make of the activity-based cost numbers.

Step by Step Answer:

Management And Cost Accounting

ISBN: 9781292232669

7th Edition

Authors: Alnoor Bhimani, Srikant M. Datar, Charles T. Horngren, Madhav V. Rajan