The board of directors of a company is considering two mutually exclusive projects. Both projects necessitate buying

Question:

The board of directors of a company is considering two mutually exclusive projects. Both projects necessitate buying new machinery, and both projects are expected to have a life of five years.

Project One This project has already been evaluated. Details of the project are:

Initial investment needed £500 000 Net present value £41 000 Accounting rate of return 31%.

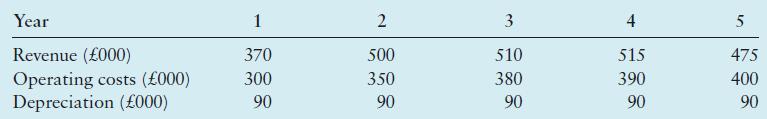

Project Two Details of project two are:

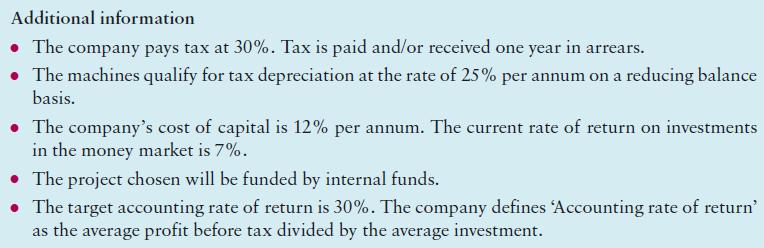

The figures for revenue and operating costs in the table above are cash-flow estimates, have been stated at current values and are assumed to occur at the year end. However, differential inflation is expected: 8% per annum for revenue and 6% per annum for operating costs. The machinery will cost £500 000 and will be sold for £50 000 cash at the end of year 5.

Required

1 a Calculate the net present value and the accounting rate of return of Project Two.

b Prepare a report for the Board of Directors which:

(i) r e c ommends which of the projects, if any, they should invest in (ii) identifies two non-financial factors that are relevant to the decision (iii) explains the strengths and weaknesses of net present value and accounting rate of return.

2 A government organisation has a fixed interest ten-year loan. The rate on the loan is 8% per annum. The loan is being repaid in equal annual instalments at the end of each year. The amount borrowed was £250 000. The loan has just over four years to run.

Ignore taxation.

Required Calculate the present value of the amount outstanding on the loan.

Step by Step Answer:

Management And Cost Accounting

ISBN: 9781292436029

8th Edition

Authors: Alnoor Bhimani, Srikant Datar, Charles Horngren, Madhav Rajan