The board of directors of a company is considering two mutually exclusive projects. Both projects necessitate buying

Question:

The board of directors of a company is considering two mutually exclusive projects. Both projects necessitate buying new machinery, and both projects are expected to have a life of five years.

Project One

This project has already been evaluated. Details of the project are:

Initial investment needed £500,000

Net present value £41,000

Accounting rate of return 31%.

Project Two

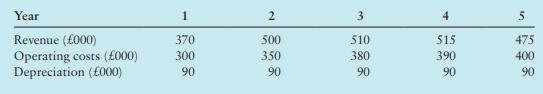

Details of project two are:

The figures for revenue and operating costs in the table above are cash-flow estimates, have been stated at current values and are assumed to occur at the year end. However, differential inflation is expected: 8% per annum for revenue and 6% per annum for operating costs. The machinery will cost £500,000 and will be sold for £50,000 cash at the end of year 5.

Additional information

● The company pays tax at 30%. Tax is paid and/or received one year in arrears.

● The machines qualify for tax depreciation at the rate of 25% per annum on a reducing balance basis.

● The company’s cost of capital is 12% per annum. The current rate of return on investments in the money market is 7%.

● The project chosen will be funded by internal funds.

● The target accounting rate of return is 30%. The company defines ‘Accounting rate of return’ as the average profit before tax divided by the average investment.

Required

1. a. Calculate the net present value and the accounting rate of return of Project Two.

b. Prepare a report for the Board of Directors which:

(i) recommends which of the projects, if any, they should invest in

(ii) identifies two non-financial factors that are relevant to the decision

(iii) explains the strengths and weaknesses of net present value and accounting rate of return.

2. A government organisation has a fixed interest ten-year loan. The rate on the loan is 8% per annum. The loan is being repaid in equal annual instalments at the end of each year. The amount borrowed was £250,000. The loan has just over four years to run. Ignore taxation.

Required

Calculate the present value of the amount outstanding on the loan.

Step by Step Answer:

Management And Cost Accounting

ISBN: 9781292232669

7th Edition

Authors: Alnoor Bhimani, Srikant M. Datar, Charles T. Horngren, Madhav V. Rajan