Hraxin Co is appraising an investment project which has an expected life of four years and which

Question:

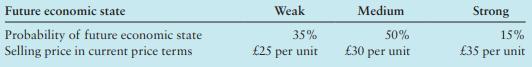

Hraxin Co is appraising an investment project which has an expected life of four years and which will not be repeated. The initial investment, payable at the start of the first year of operation, is £5 million. Scrap value of £500,000 is expected to arise at the end of four years. There is some uncertainty about what price can be charged for the units produced by the investment project, as this is expected to depend on the future state of the economy. The following forecast of selling prices and their probabilities has been prepared:

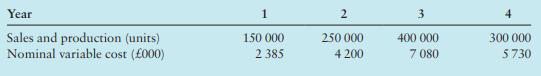

These selling prices are expected to be subject to annual inflation of 4% per year, regardless of which economic state prevails in the future. Forecast sales and production volumes, and total nominal variable costs, have already been forecast, as follows:

Incremental overheads of £400,000 per year in current price terms will arise as a result of undertaking the investment project. A large proportion of these overheads relate to energy costs which are expected to increase sharply in the future because of energy supply shortages, so overhead inflation of 10% per year is expected.

The initial investment will attract tax-allowable depreciation on a straight-line basis over the four-year project life. The rate of corporation tax t is 30% and tax liabilities are paid in the year in which they arise. Hraxin Co has traditionally used a nominal after-tax discount rate of 11% per year for investment appraisal.

Required

1. Calculate the expected net present value of the investment project and comment on its financial acceptability.

2. Critically discuss if sensitivity analysis will assist Hraxin Co in assessing the risk of the investment project.

Step by Step Answer:

Management And Cost Accounting

ISBN: 9781292232669

7th Edition

Authors: Alnoor Bhimani, Srikant M. Datar, Charles T. Horngren, Madhav V. Rajan