Perry Enterprises is considering a number of investment possibilities. Specifically, each investment under consideration will draw on

Question:

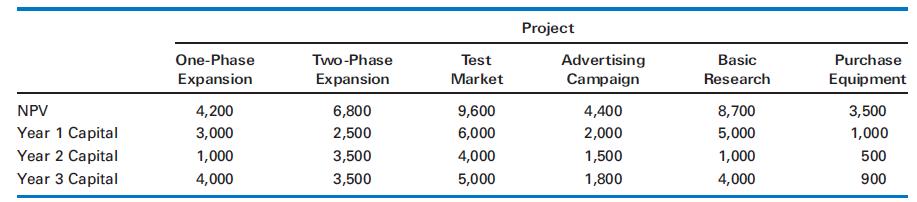

Perry Enterprises is considering a number of investment possibilities. Specifically, each investment under consideration will draw on the capital account during each of its first three years, but in the long run, each is predicted to achieve a positive net present value (NPV). Listed below are the investment alternatives, their net present values, and their capital requirements, and all figures are in thousands of dollars. In addition, the amount of capital available to the investments in each of the next three years is predicted to be $9.5 million, $7.5 million, and $8.8 million, respectively.

a. Assuming that any combination of the investments is permitted, which ones should Perry make to maximize NPV?

b. What is the optimal NPV in the combination chosen in part (a)?

c. Suppose that the expansion investments are mutually exclusive and only one of them can be made. How does this alter the solution in part (a)?

d. Suppose that the test market cannot be carried out unless the advertising campaign is also adopted. How does this contingency alter the solution in (a)?

Step by Step Answer:

Management Science The Art Of Modeling With Spreadsheets

ISBN: 9780470530672

3rd Edition

Authors: Stephen G. Powell, Kenneth R. Baker