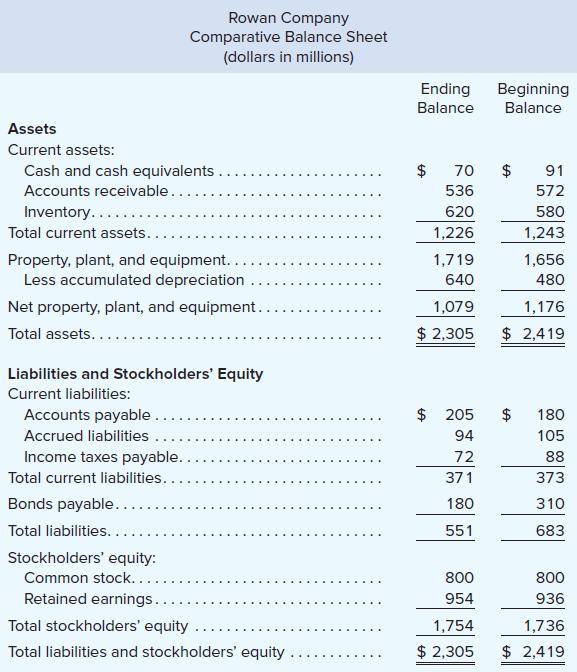

A comparative balance sheet and an income statement for Rowan Company are given below: Rowan Company Income

Question:

A comparative balance sheet and an income statement for Rowan Company are given below:

Rowan Company

Income Statement

For the Year Ended December 31

(dollars in millions)

Sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 4,350

Cost of goods sold . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,470

Gross margin . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 880

Selling and administrative expenses . . . . . . . . . . . . . . . . . 820

Net operating income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 60

Nonoperating items: Gain on sale of equipment . . . . . . . 4

Income before taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 64

Income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 42

Rowan also provided the following information:

1. The company sold equipment that had an original cost of $16 million and accumulated depreciation of $9 million. The cash proceeds from the sale were $11 million. The gain on the sale was $4 million.

2. The company did not issue any new bonds during the year.

3. The company paid a cash dividend during the year.

4. The company did not complete any common stock transactions during the year.

Required:

1. Using the indirect method, prepare a statement of cash flows for the year.

2. Calculate the free cash flow for the year.

3. To help Rowan assess its liquidity at the end of the year, calculate the following:

a. Current ratio

b. Acid-test (quick) ratio

4. To help Rowan assess its asset management, calculate the following:

a. Average collection period (assuming all sales are on account)

b. Average sale period

5. To help Rowan assess its debt management, calculate the following:

a. Debt-to-equity ratio at the end of the year

b. Equity multiplier

6. To help Rowan assess its profitability, calculate the following:

a. Net profit margin percentage

b. Return on equity

7. To help Rowan assess its market performance, calculate the following (assume the par value of the company’s common stock is $10 per share):

a. Earnings per share

b. Dividend payout ratio

Step by Step Answer:

Managerial Accounting

ISBN: 9781260247787

17th Edition

Authors: Ray Garrison, Eric Noreen, Peter Brewer