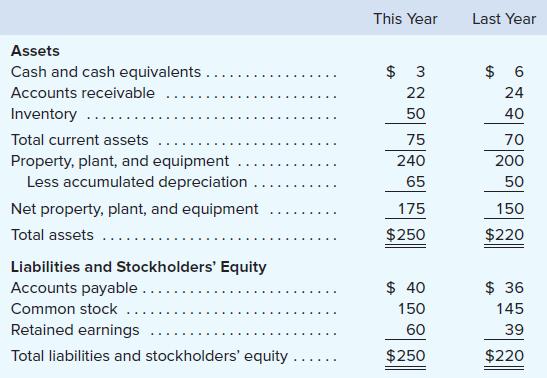

Comparative financial statement data for Carmono Company follow: For this year, the company reported net income as

Question:

Comparative financial statement data for Carmono Company follow:

For this year, the company reported net income as follows:

Sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 275

Cost of goods sold. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 150

Gross margin . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 125

Selling and administrative expenses . . . . . . . . . . . . . . . 90

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 35

This year Carmono declared and paid a cash dividend. There were no sales of property, plant, and equipment during this year. The company did not repurchase any of its own stock this year.

Required:

1. Using the indirect method, prepare a statement of cash flows for this year.

2. Compute Carmono’s free cash flow for this year.

Step by Step Answer:

Managerial Accounting

ISBN: 9781260247787

17th Edition

Authors: Ray Garrison, Eric Noreen, Peter Brewer