Holiday Travel Australasia commenced business on 1 April 2016. Alice Adare is a good manager but a

Question:

Holiday Travel Australasia commenced business on 1 April 2016. Alice Adare is a good manager but a poor accountant. From the trial balance prepared by a part-time bookkeeper, Alice prepared the following statement of profit or loss for the year ended 31 March 2017 on the following page. Alice knew something was wrong with the statement because profit up to February had not exceeded $40 000. Knowing that you are an experienced accountant, she asks you to review the statement of profit or loss and other data.

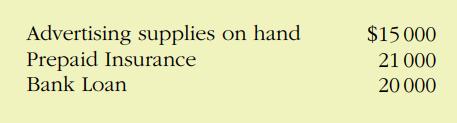

You first look at the trial balance. In addition to the account balances reported in the statement of profit or loss, the general ledger contains these selected balances at 31 March 2017.

You then make enquiries and discover the following:

1. Service revenues include advanced money for holidays after March, $16 000.

2. There were only $5200 of advertising supplies on hand at 31 March.

3. Prepaid insurance resulted from the payment of a 1-year policy on 1 July 2016.

4. The following invoices have not been paid or recorded: advertising for week of 24 March, $3200; repairs made 10 March, $2000; and electricity expense, $320.

5. At 31 March, 2 days’ wages had not been paid or recorded, amounting to $300.

6. The business took out the loan on 1 January 2017 at an annual interest rate of 10%.

Required

With the class divided into groups, answer the following:

(a) Prepare a correct statement of profit or loss for the year ended 31 March 2017.

(b) Explain to Alice the generally accepted accounting principles that she did not follow in preparing her statement of profit or loss and their effect on her results.

Step by Step Answer:

Financial Accounting Reporting Analysis And Decision Making

ISBN: 9780730313748

5th Edition

Authors: Shirley Carlon, Rosina Mladenovic Mcalpine, Chrisann Palm, Lorena Mitrione, Ngaire Kirk, Lily Wong