Slavko Mitrovic is one of the owners of Salami 4 U, a small business that manufactures and

Question:

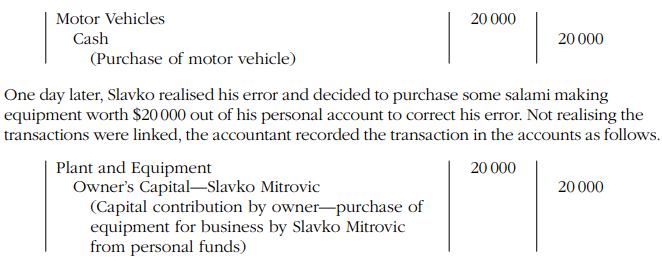

Slavko Mitrovic is one of the owners of Salami 4 U, a small business that manufactures and sells organic salami and other small goods. Slavko also manages the business on a part-time basis, sharing the responsibilities with the other partners. Using the business cheque book by accident, Slavko recently purchased a car for his beautiful wife Natasha Mitrovic as a birthday present. Natasha is a sales representative for a large computer company and will be using the car in her job. Based on the cheque butt, the accountant recorded the transaction in the accounts of Salami 4 U as follows.

Required

(a) For each of the transactions recorded above:

(i) Determine if they have been recorded correctly or incorrectly based on the concepts and principles that underlie the recording of accounting transactions.

(ii) If any transactions have been recorded incorrectly, discuss how the accounting concept(s) or principle(s) have been breeched.

(iii) If any transactions have been recorded incorrectly, prepare BOTH the correcting entry to correct the recorded error as well as the correct journal entry that should have been recorded by the accountant in the first instance. Ignore GST.

(b) What if the car had been purchased for use by Slavko only when he was working in the business? Under these circumstances, explain whether the transactions have been recorded correctly or incorrectly based on the concepts and principles that underlie the recording of accounting transactions.

Step by Step Answer:

Financial Accounting Reporting Analysis And Decision Making

ISBN: 9780730313748

5th Edition

Authors: Shirley Carlon, Rosina Mladenovic Mcalpine, Chrisann Palm, Lorena Mitrione, Ngaire Kirk, Lily Wong