Castle Dale Company uses activity-based costing (ABC). The controller identified two activities and their budgeted costs: Setting

Question:

Castle Dale Company uses activity-based costing (ABC). The controller identified two activities and their budgeted costs:

Setting up equipment: $ 864,000

Other overhead: 2,880,000

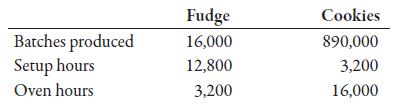

Setting up equipment is based on setup hours, and other overhead is based on oven hours. Castle Dale produces two products, Fudge and Cookies. Information on each product is as follows:

Required:

1. Calculate the activity rate for (a) setting up equipment and (b) other overhead.

2. How much total overhead is assigned to Fudge using ABC?

3. What is the unit overhead assigned to Fudge using ABC?

4. Now, ignoring the ABC results, calculate the plantwide overhead rate, based on oven hours.

5. How much total overhead is assigned to Fudge using the plantwide overhead rate?

6. Explain why the total overhead assigned to Fudge is different under the ABC system (i.e., using the activity rates) than under the non-ABC system (i.e., using the plantwide rate).

Step by Step Answer:

Managerial Accounting The Cornerstone Of Business Decision Making

ISBN: 9780357715345

8th Edition

Authors: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger