UOP is a manufacturing firm that has depreciation as its only overhead expense (i.e., there are no

Question:

UOP is a manufacturing firm that has depreciation as its only overhead expense (i.e., there are no indirect labor, indirect materials, property taxes, factory insurance, etc.). UOP uses a flexible budget at the beginning of the year to forecast overhead in calculating the overhead rate. Overhead is assigned to products based on machine hours.

UOP uses units-of-production depreciation to calculate depreciation. A single machine manufactures all products. Its original cost is $600,000 and it has an estimated useful life of 10,000 machine hours.

UOP manufactures two products: A and B. Units-of-production depreciation is based on standard machine hours used. UOP assigns overhead to products based on standard machine hours, not actual machine hours.

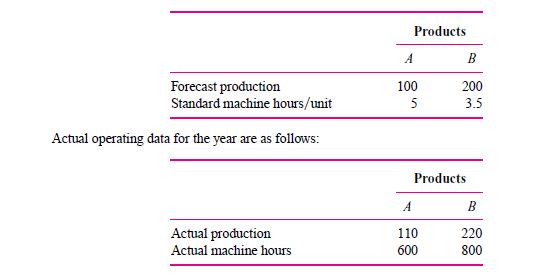

The following budgeted data were produced at the beginning of the year:

Required:

a. Calculate the overhead rate per machine hour and the amount of budgeted overhead for the year.

b. Calculate the total overhead absorbed to products during the year.

c. Calculate the over/underabsorbed overhead for the year.

d. Suppose UOP still assigns overhead to products based on standard machine hours, but now calculates units-of-production depreciation using actual machine hours. How much is the over/underabsorbed overhead?

e. Explain any difference between your answers to parts (c) and (d) above. What causes the difference? Why might UOP prefer the accounting treatment described in part (d) over that in part (c)?

Step by Step Answer:

Accounting For Decision Making And Control

ISBN: 9780078136726

7th Edition

Authors: Jerold Zimmerman