Question: Activity-based costing (ABC) systems are useful in helping companies make better decisions about pricing, product mix, and cost management related to product design and efficiency.

Activity-based costing (ABC) systems are useful in helping companies make better decisions about pricing, product mix, and cost management related to product design and efficiency. In fact, General Mills used ABC to identify and analyze the costs associated with the different channels used to market its Colombo frozen yogurt products.

Before performing ABC analysis, General Mills charged the same prices and provided the same promotions-$ 3 per case-to its customers, whether the customer was in the grocery channel (food purchased for later consumption or preparation at home) or the food-service (outside of home, immediate consumption) channel. Upon closer examination of the food-service channel, General Mills discovered segments within food service: destination yogurt shops or restaurants and impulse locations, located in business cafeterias and on school campuses and military bases. General Mills also noticed that sales dollars for frozen yogurt products were relatively constant, but profits were declining. The company sensed that destination yogurt shops might be more profitable than impulse locations, but it didn't have the information about profit differences to make changes. General Mills' logic was: Destination shops/restaurants focus on maximizing profit per square foot and managing guest cheque averages. However, impulse locations focus on cost per serving, and this segment of the business was growing at a much faster rate than the destination shop segment.

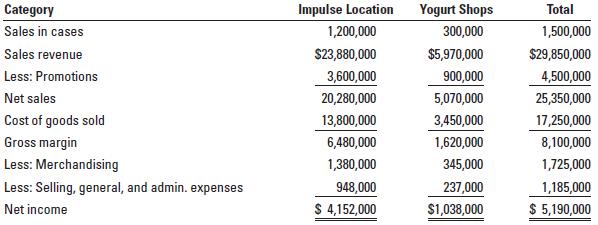

The case sales data and income statements for last year, by segment, looked like this:

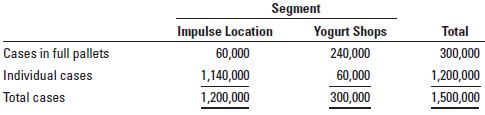

Cost of goods sold includes $14,250,000 for ingredients, packaging, and storage, and $3,000,000 for picking, packing, and shipping. The product is the same across segments, so cost to produce is the same. However, picking, packing, and shipping costs vary if the order is for a full pallet. Full pallets cost $75 to pick and ship, where individual orders cost $2.25 per case. There are 75 cases in a pallet, with pallet and case usage by segment shown here:

For merchandising, costs consist mainly of kits selling for $500 each. A total of 3,450 kits were delivered in the period, 90 of them to yogurt shops. For selling, general, and administration, costs were allocated to products based on gross sales dollars. When a random sample of the sales force was asked to keep diaries for 60 days, the resulting data revealed they spent much more time per sales dollar on yogurt sales than other General Mills products they represented. Thus, when selling, general, and administration costs were allocated based on time, the total allocation to yogurt products jumped from $1,185,000 to $3,900,000. Of the total time spent on selling Colombo frozen yogurt, only 1% of that time was spent in shops.

Required

1. How do the two segments identified by General Mills for Colombo frozen yogurt sales differ from each other?

2. Using ABC analysis, restate the income statements above to show new net income ( Hint: add a line item for shipping). What is “per case” net income?

3. Based on your analysis in requirement 2, what changes should General Mills make?

Step by Step Solution

3.46 Rating (169 Votes )

There are 3 Steps involved in it

1 The two segments identified by General Mills for Colombo frozen yogurt sales namely impulse locations and yogurt shops differ from each other in several aspects a Market Focus Impulse locations are ... View full answer

Get step-by-step solutions from verified subject matter experts