Anderson Company must evaluate two capital expenditure proposals. Andersons hurdle rate is 12%. Data for the two

Question:

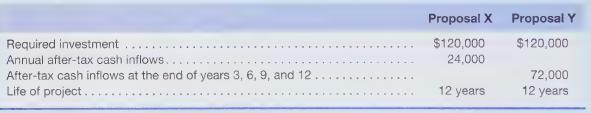

Anderson Company must evaluate two capital expenditure proposals.

Anderson’s hurdle rate is 12%. Data for the two proposals follow.

Using net present value analysis, which proposal is the more attractive? If Anderson has sufficient funds available, should both proposals be accepted?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Managerial Accounting For Undergraduates

ISBN: 9781618531124

1st Edition

Authors: Christensen, Theodore E. Hobson, L. Scott Wallace, James S.

Question Posted: