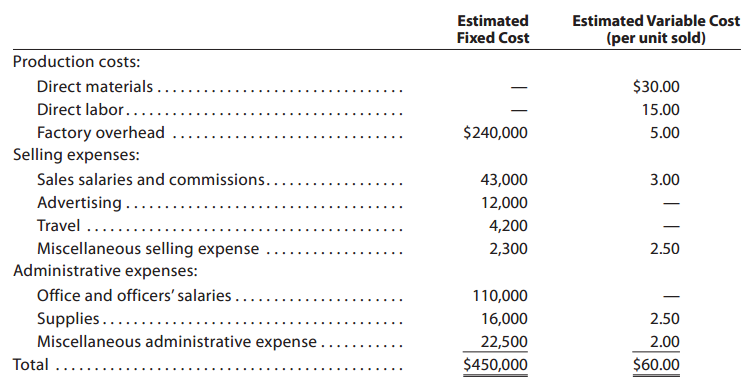

Question: Baker Co. expects to maintain the same inventories at the end of 2012 as at the beginning of the year. The total of all production

It is expected that 40,000 units will be sold at a price of $75 a unit. Maximum sales within the relevant range are 45,000 units.

1. Prepare an estimated income statement for 2012.

2. What is the expected contribution margin ratio?

3. Determine the break-even sales in units and dollars.

4. Construct a cost-volume-profit chart indicating the break-even sales.

5. What is the expected margin of safety in dollars and as a percentage of sales?

6. Determine the operating leverage.

Estimated Estimated Variable Cost Fixed Cost (per unit sold) Production costs: Direct materials... $30.00 Direct labor.... 15.00 $240,000 Factory overhead Selling expenses: Sales salaries and commissions... Advertising 5.00 3.00 43,000 12,000 Travel ...... 4,200 Miscellaneous selling expense 2,300 2.50 Administrative expenses: Office and officers' salaries . 110,000 Supplies...... Miscellaneous administrative expense 2.50 16,000 22,500 2.00 $450,000 $60.00 Total ...

Step by Step Solution

3.45 Rating (171 Votes )

There are 3 Steps involved in it

1 2 3 4 5 6 Sales Cost of goods sold Direct materials Direct ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

1737_605f3e29634a4_723479.xlsx

300 KBs Excel File