Below is a list of aspects of various capital expenditure proposals that the capital budgeting team of

Question:

Below is a list of aspects of various capital expenditure proposals that the capital budgeting team of Modern Systems, Inc., has incorporated into its net present value analyses during the past year. Unless otherwise noted, the items listed are unrelated to each other. All situations assume a 30% income tax rate and a 10% minimum desired rate of return.

1.Pre-tax savings of \($5,000\) in cash expenses will occur in each of the next three years.

2.A machine is purchased now for \($82,000.

3.Special\) tools costing \($45,000\) will be depreciated \($9,000,\) \($18,000,\) and \($18,000,\) respectively, on the tax return over a three-year life.

4.Appetent purchased for \($330,000\) will be amortized on a straight-line basis over 15 years on the tax return. No salvage value is expected.

5.Pre-tax savings of \($8,000\) in cash expenses will occur in each of the next seven years.

6.Pre-tax savings of \($5,500\) in cash expenses will occur in the first, fourth, and seventh years from now.

7.The special tools described in aspect 3 will be sold after three years for \($10,000\) cash.

8.A truck with a tax book value of \($7,200\) after two years will be sold at that time for \($4,600\) .

Required

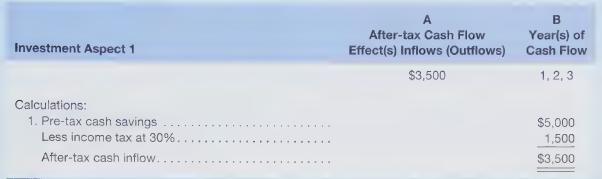

Set up an answer form with the four column headings as shown below. Answer each investment aspect separately. Prepare your calculations on a separate paper and key them to each item. The answer to investment aspect | is presented as an example.

a. Calculate and record in column A the related after-tax cash flow effect(s). Place parentheses around outflows.

b. Indicate in column B the timing of each cash flow shown in column A. Use 0 to indicate immediately and 1, 2, 3, 4, and so on for each year involved.

Step by Step Answer:

Managerial Accounting For Undergraduates

ISBN: 9781618531124

1st Edition

Authors: Christensen, Theodore E. Hobson, L. Scott Wallace, James S.