Brown Inc. manufactures and distributes two types of household items. The items, Mops and Dusters, are manufactured

Question:

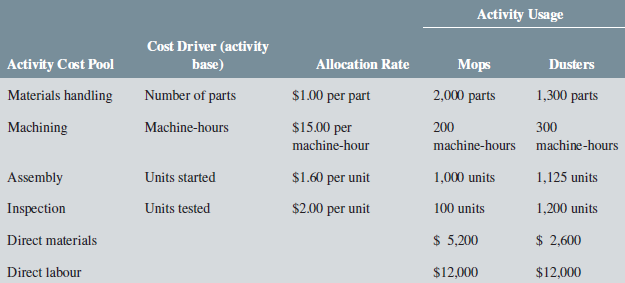

Brown Inc. manufactures and distributes two types of household items. The items, Mops and Dusters, are manufactured on a common assembly line by the same direct labourers. Different direct materials are used in each type, and the machinery is retooled for each product. Until now, manufacturing overhead costs have been allocated on the basis of direct labour-hours using a plantwide rate. However, the production manager has been reading about ABC and wishes to institute it for Brown?s production operations. To that end, she has assembled the following information regarding production activities and manufacturing overhead costs for the month of September:

Each product consumed 600 direct labour-hours.

Required:

1. Using ABC, determine the total manufacturing cost and cost per unit for each of the two product lines for September, assuming that all units were started and completed in September.

2. Using the plantwide rate to allocate manufacturing overhead, determine the total manufacturing cost per unit for each of the two product lines for September, assuming that all units were started and completed in September.

3. With reference to the results of the analysis in parts (1) and (2), briefly explain the implications of using the ABC costing approach instead of using the plantwide rate to determining the cost of Mops and Dusters.

4. Briefly explain how the allocation rate for materials handling would have been calculated. Is it true that the planned number of parts to be handled is 3,300 parts? Explain.

5. Will you recommend that the activity rate be calculated using actual cost in each cost pool and the actual activity usage? Explain.

Step by Step Answer:

Introduction to Managerial Accounting

ISBN: 978-1259105708

5th Canadian edition

Authors: Peter C. Brewer, Ray H. Garrison, Eric Noreen, Suresh Kalagnanam, Ganesh Vaidyanathan