Pro Audio Inc. manufactures two products: receivers and loudspeakers. The factory over-head incurred is as follows: Indirect

Question:

Indirect labor.................................................$260,000

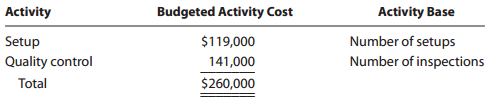

Sub assembly Department............................145,000

Final Assembly Department............................95,000

________

Total...............................................................$500,000

The activity base associated with the two production departments is direct labor hours. The indirect labor can be assigned to two different activities as follows:

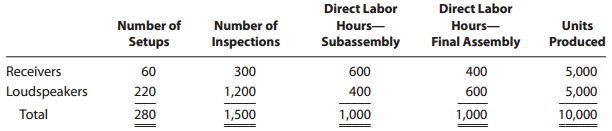

The activity-base usage quantities and units produced for the two products are shown below.

1. Determine the factory overhead rates under the multiple production department rate method. Assume that indirect labor is associated with the production departments, so that the total factory overhead is $275,000 and $225,000 for the Sub-assembly and Final Assembly departments, respectively.

2. Determine the total and per-unit factory overhead costs allocated to each product, using the multiple production department overhead rates in (1).

3. Determine the activity rates, assuming that the indirect labor is associated with activities rather than with the production departments.

4 . Determine the total and per-unit cost assigned to each product under activity-based costing.

5. Explain the difference in the per-unit overhead allocated to each product under the multiple production department factory overhead rate and activity-based costing methods.

Step by Step Answer:

Financial and Managerial Accounting Using Excel for Success

ISBN: 978-1111993979

1st edition

Authors: James Reeve, Carl S. Warren, Jonathan Duchac