Profits have been decreasing for several years at Pegasus Airlines. In an effort to improve the company?s

Question:

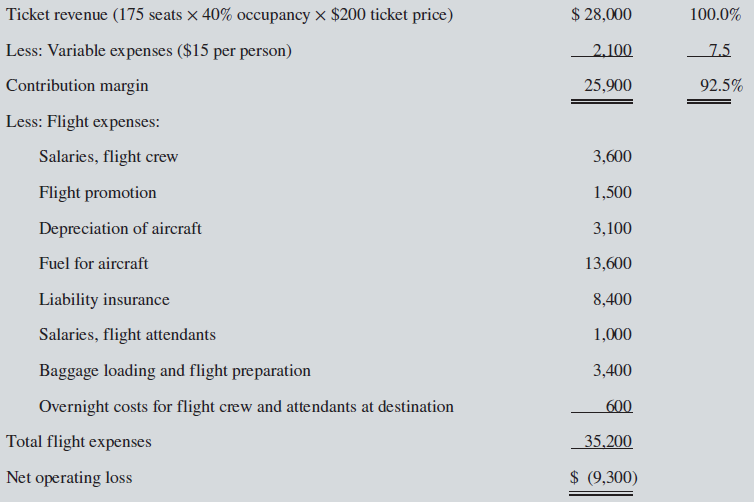

Profits have been decreasing for several years at Pegasus Airlines. In an effort to improve the company?s performance, consideration is being given to dropping several flights that appear to be unprofitable. A typical income statement for one such flight (Flight 482) follows:

The following additional information is available about Flight 482:

a. Members of the flight crew are paid fixed annual salaries, whereas the flight attendants are paid by the flight.

b. One-third of the liability insurance is a special charge assessed against Flight 482 because, in the opinion of the insurance company, the destination is in a high-risk area. The remaining two-thirds would be unaffected by a decision to drop Flight 482.

c. The baggage loading and flight preparation expense is an allocation of ground crew?s salaries and depreciation of ground equipment. Dropping Flight 482 would have no effect on the company?s total baggage loading and flight preparation expenses.

d. If Flight 482 is dropped, Pegasus Airlines has no authorization at present to replace it with another flight.

e. Depreciation of aircraft is due entirely to obsolescence. Depreciation due to wear and tear is negligible.

f. Dropping Flight 482 would not allow Pegasus Airlines to reduce the number of aircraft in its fleet or the number of flight crew on its payroll.

Required:

1. Prepare an analysis showing what impact dropping Flight 482 would have on the airline?s profits.

2. The airline?s scheduling officer has been criticized because only about 50% of the seats on Pegasus?s flights are being filled, compared with an average of 60% for the industry. The scheduling officer has explained that Pegasus?s average seat occupancy could be improved considerably by eliminating about 10% of the flights but that doing so would reduce profits. Explain how this could happen.

Step by Step Answer:

Introduction to Managerial Accounting

ISBN: 978-1259105708

5th Canadian edition

Authors: Peter C. Brewer, Ray H. Garrison, Eric Noreen, Suresh Kalagnanam, Ganesh Vaidyanathan