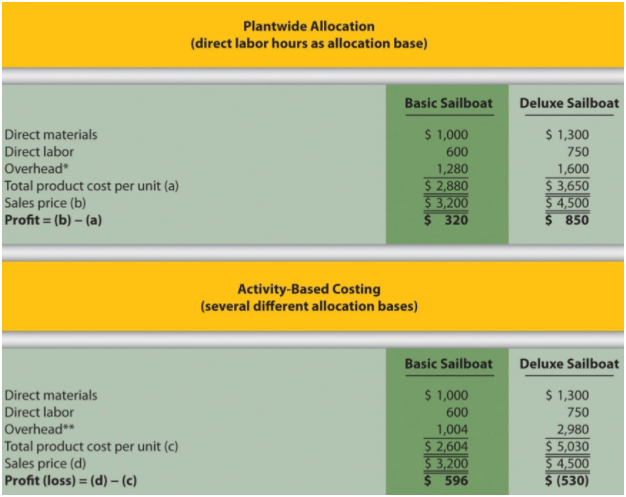

Recall from the chapter discussion that SailRite uses one plantwide rate based on direct labor hours to

Question:

Although management of SailRite prefers the accuracy of activity-based costing, the cost of maintaining such an accounting system for the long term is prohibitive. John, the accountant, has proposed going back to using one plantwide rate, but he would like to allocate overhead costs using machine hours rather than direct labor hours.

Recall that overhead costs totaled $8,000,000. A total of 90,000 machine hours were used for the period: 50,000 for Basic sailboats and 40,000 for Deluxe sailboats. The company produced 5,000 units of the Basic model and 1,000 units of the Deluxe model. Thus, the Basic model uses 10 machine hours per unit (= 50,000 machine hours ÷ 5,000 units) and the Deluxe model uses 40 machine hours per unit (= 40,000 machine hours ÷ 1,000 units).

Required:

a. Calculate the predetermined overhead rate using machine hours as the allocation base, and determine the overhead cost per unit allocated to the Basic and Deluxe sailboats. Round results to the nearest cent.

b. For each product, calculate the unit product cost and profit using the same format presented previously. Round results to the nearest cent.

c. Compare your results in requirement b to the results using direct labor hours as the allocation base and activity-based costing.

d. Provide at least two reasons why management might prefer machine hours as the overhead allocation base rather than direct labor hours or activity-based costing.

Step by Step Answer: