Olaf lives in the state of Minnesota. A tornado hit the area and damaged his home and

Question:

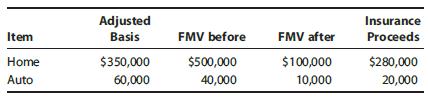

Olaf lives in the state of Minnesota. A tornado hit the area and damaged his home and automobile. Applicable information is as follows:

Because of the extensive damage caused by the tornado, the President designated the area a disaster area.

Olaf and his wife, Anna, always file a joint return. Their 2015 tax return shows AGI of $180,000 and taxable income of $140,000. In 2016, their return shows AGI of $300,000 and taxable income (exclusive of the casualty loss deduction) of $215,000.

Determine the amount of Olaf and Anna’s loss and the year in which they should take the loss.

Transcribed Image Text:

Item Home Auto Adjusted Basis $350,000 60,000 FMV before $500,000 40,000 FMV after $100,000 10,000 Insurance Proceeds $280,000 20,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

Olaf and Anna experienced a casualty loss due to the tornado damage to their home and automobile To determine the amount of their casualty loss and th...View the full answer

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

South Western Federal Taxation 2017 Comprehensive

ISBN: 9781305874169

40th Edition

Authors: William H. Hoffman, David M. Maloney, William A. Raabe, James C. Young

Question Posted:

Students also viewed these Business questions

-

Olaf lives in the state of Minnesota. A tornado hit the area and damaged his home and automobile. Applicable information is as follows: Because of the extensive damage caused by the tornado, the...

-

Olaf lives in the state of Minnesota. A tornado hit the area and damaged his home and automobile. Applicable information is as follows: Because of the extensive damage caused by the tornado, the...

-

Olaf lives in the state of Minnesota. A tornado hit the area and damaged his home and automobile. Applicable information is as follows: Because of the extensive damage caused by the tornado, the...

-

Head movement evaluations are important because disabled individuals may be able to operate communications aids using head motion. The paper Constancy of Head Turning Recorded in Healthy Young Humans...

-

At an interest rate of 10% per year, the capitalized cost of $10,000 in year 0, $5000 per year in years 1 through 5, and $1000 per year thereafter forever is closest to: (a) $29,652 (b) $35,163 (c)...

-

For the reaction 2Cu(s) + S(s) Cu2S(s) Ho and Go are negative and So is positive. a. At equilibrium, will reactants or products predominate? Why? b. Why must the reaction system be heated in order...

-

Although radiation is important in heat transfer, an analogous model can be used in the design of photochemical reactors. The modeling of these reactors requires that the radiation intensity be...

-

Table gives hypothetical export price indexes and import price indexes (1990 100) for Japan, Canada, and Ireland. Compute the commodity terms of trade for each country for the period 19902006. Which...

-

what extent does the reciprocal exchange of feedback and constructive critique within the mentorship dyad serve as a catalyst for personal and professional metamorphosis, engendering a culture of...

-

Olaf lives in the state of Minnesota. A tornado hit the area and damaged his home and automobile. Applicable information is as follows: Because of the extensive damage caused by the tornado, the...

-

Sarah Ham, operating as a sole proprietor, manufactures printers in the United States. For 2016, the proprietorship has QPAI of $400,000. Sarahs modified AGI was $350,000. The W2 wages paid by the...

-

Given that I-127 is the only natural isotope of iodine, what is the mass of one I atom and Avogadros number of I atoms, respectively?

-

True or false? Models provide both theorems and precepts. Explain your answer.

-

How does game theory demonstrate the importance of institutions? (Institutionalist)

-

Is it ever appropriate for society to: Let someone starve? Let someone be homeless? Forbid someone to eat chocolate?

-

What does it mean to let the data speak?

-

List four conditions you believe should hold before you would argue that two individuals should get the same amount of income. a. How would you apply the conditions to your views on welfare? b. How...

-

Janet Markleson ran a profitable used-car business until the business failed as a result of an embezzling financial manager. The officers of the company were as follows: Janet was the president and...

-

State whether each of the following will increase or decrease the power of a one-way between-subjects ANOVA. (a) The effect size increases. (b) Mean square error decreases. (c) Mean square between...

-

The Signet Corporation has issued four-month commercial paper with a $6 million face value. The firm netted $5,870,850 on the sale. What effective annual rate is Signet paying for these funds?

-

The Ohio Valley Steel Corporation has borrowed $5 million for one month at a stated annual rate of 9%, using inventory stored in a field warehouse as collateral. The warehouser charges a $5000 fee,...

-

The Rasputin Brewery is considering using a public warehouse loan as part of its short-term financing. The firm will require a loan of $500,000. Interest on the loan will be 10% (APR, annual...

-

1. Multiply out the following brackets: (i) 3(2 + x) (iv) p(x + 2) (ii) 3(2 + 4x) (v) 3p(2 x) (iii) 2(4x 3) (vi) p(x + p) 2. Multiply out the following brackets: (i) (v 2)(v 2) [same as (v 2)2]...

-

Prior to patients surgery. the surgeon prescribes a musde relaxant. dantrium (Dantrolene) 05 mg/kg. The package comes 10 mg/mL. Patient weighs 40 kg How many mL's of dantrium (Dantrolene) should she...

-

Charles Campbell is the founder of Expeditions Unlimited, a specialty travel service that researches and arranges trips to unlikely places. He is famous for his unconventional approach to business,...

Study smarter with the SolutionInn App