Question: Refer to E8-31A. InteliSystems needs 79,000 optical switches next year (assume same relevant range). By outsourcing them, InteliSystems can use its idle facilities to manufacture

Refer to E8-31A. InteliSystems needs 79,000 optical switches next year (assume same relevant range). By outsourcing them, InteliSystems can use its idle facilities to manufacture another product that will contribute \($140,000\) to operating income, but none of the fixed costs will be avoidable. Should InteliSystems make or buy the switches?

Show your analysis.

Data From E8-31A:-

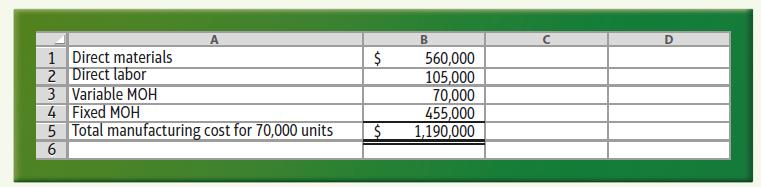

InteliSystems manufactures an optical switch that it uses in its final product. InteliSystems incurred the following manufacturing costs when it produced 70,000 units last year:

InteliSystems does not yet know how many switches it will need this year; however, another company has offered to sell InteliSystems the switch for \($8.50\) per unit. If InteliSystems buys the switch from the outside supplier, the manufacturing facilities that will be idle cannot be used for any other purpose; yet none of the fixed costs are avoidable.

Requirements:

1. Given the same cost structure, should InteliSystems make or buy the switch? Show your analysis.

2. Now, assume that InteliSystems can avoid \($105,000\) of fixed costs a year by outsourcing production. In addition, because sales are increasing, InteliSystems needs 75,000 switches a year rather than 70,000 switches. What should the company do now?

3. Given the last scenario, what is the most InteliSystems would be willing to pay to outsource the switches?

1 Direct materials 2 Direct labor 3 Variable MOH 4 Fixed MOH A $ 5 Total manufacturing cost for 70,000 units 6 B 560,000 105,000 70,000 455,000 $ 1,190,000 C D

Step by Step Solution

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts