Question: Select Physical Therapy Inc. is planning its cash payments for operations for the third quarter ( JulySeptember), 2013. The Accrued Expenses Payable balance on July

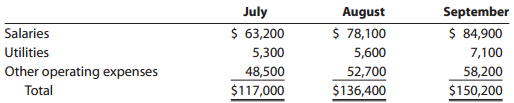

Select Physical Therapy Inc. is planning its cash payments for operations for the third quarter ( July€“September), 2013. The Accrued Expenses Payable balance on July 1 is $28,000. The budgeted expenses for the next three months are as follows:

Other operating expenses include $3,500 of monthly depreciation expense and $800 of monthly insurance expense that was prepaid for the year on March 1 of the current year. Of the remaining expenses, 70% are paid in the month in which they are incurred, with the remainder paid in the following month. The Accrued Expenses Payable balance on July 1 relates to the expenses incurred in June. Prepare a schedule of cash payments for operations for July, August, and September.

September $ 84,900 July August $ 78,100 5,600 Salaries Utilities Other operating expenses $ 63,200 5,300 7,100 48,500 $117,000 52,700 $136,400 58,200 $150,200 Total

Step by Step Solution

3.52 Rating (166 Votes )

There are 3 Steps involved in it

1 3 4 5 6 2 SELECT PHYSICAL THERAPY INC Schedule of Cash Payments for Operations For the Three Month... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

1737_605f5a068a033_723488.xlsx

300 KBs Excel File