The Minnesota Scooter Company produces several types of scooters. The controller has created an Excel file from

Question:

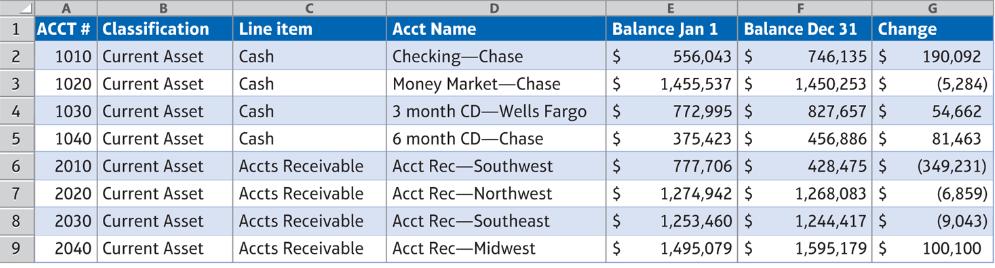

The Minnesota Scooter Company produces several types of scooters. The controller has created an Excel file from the company’s general ledger data for the past fiscal year. A sample of that Excel general ledger data file follows.

Net income for the past fiscal year was $1,615,000, while depreciation expense totaled $405,597. There were no sales or disposals of property and equipment during the fiscal year.

Using the file provided in MyLab Accounting, create a pivot table that summarizes the information by “Line item” (Rows box) and “Change” (Values box). Fill in the following change totals from the pivot table.

Requirements

a. Accrued expenses

b. Accts Payable

c. Accts Receivable

d. Accum. Depreciation

e. Cash

f. Common stock

g. Current portion LT debt

h. Goodwill

i. Income tax payable

j. Interest payable

k. Inventory

l. Investments

m. LT bonds payable

n. LT notes payable

o. Preferred stock

p. Prepaid expenses

q. Property, Plant, Equip

r. Retained earnings

s. Wages payable

2. Add a slicer based on “Classification” to the pivot table you created for Requirement 1. Use the slicer to get the totals of the change in Current Assets and the change in Current Liabilities.

3. Calculate “Net cash provided by (used by) operating activities” for the past fiscal year.

Step by Step Answer: