Wally Steel Division is a unit of Wally Industries which produces tool and die machinery for manufacturers.

Question:

Wally Steel Division is a unit of Wally Industries which produces tool and die machinery for manufacturers. The steel division operates as one of several separate investment centres of Wally Industries.

The investment centres are evaluated on the basis of ROI. Management bonuses are also based on ROI. All investments in operating assets are expected to earn a minimum rate of return of 10%.

Divisional ROI of the steel division has ranged from 12% to 15% since it was acquired by the parent company. During the past year, the steel division had an investment opportunity that would yield an estimated rate of return of 12%. But the divisional management decided against the investment because it believed the investment would decrease the division?s overall ROI.

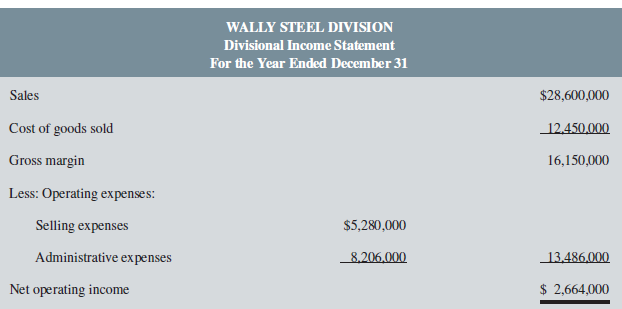

Last year?s income statement forWally Steel Division is given below. The division?s operating assets employed were $19,440,000 at the end of the year, which represents an 8% increase over the previous year-end balance.

Required:

1. Compute the average operating assets for the year.

2. Compute the ROI of the division. State the ROI in terms of margin and turnover.

3. Compute the residual income for the steel division.

4. Did the management ofWally Steel Division err in rejecting the investment opportunity it had last year? Why?

5. Would last year?s investment opportunity have been rejectedif RI were used as a performance measure instead of ROI? Explain.

6. Wally Steel Division is a separate investment centre within Wally Industries. Identify the items the division must be free to control if it is to be evaluated fairly by either the ROI or RI performance measure.

Step by Step Answer:

Introduction to Managerial Accounting

ISBN: 978-1259105708

5th Canadian edition

Authors: Peter C. Brewer, Ray H. Garrison, Eric Noreen, Suresh Kalagnanam, Ganesh Vaidyanathan