You have just been hired as a loan officer at Westmount Bank. Your supervisor has given you

Question:

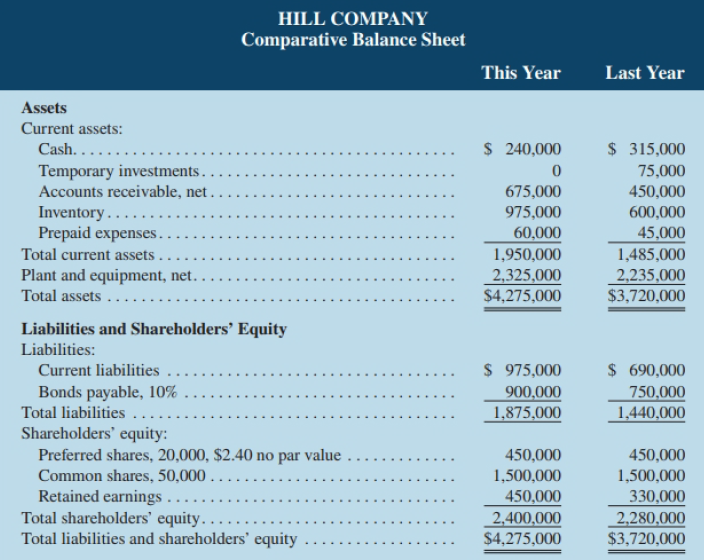

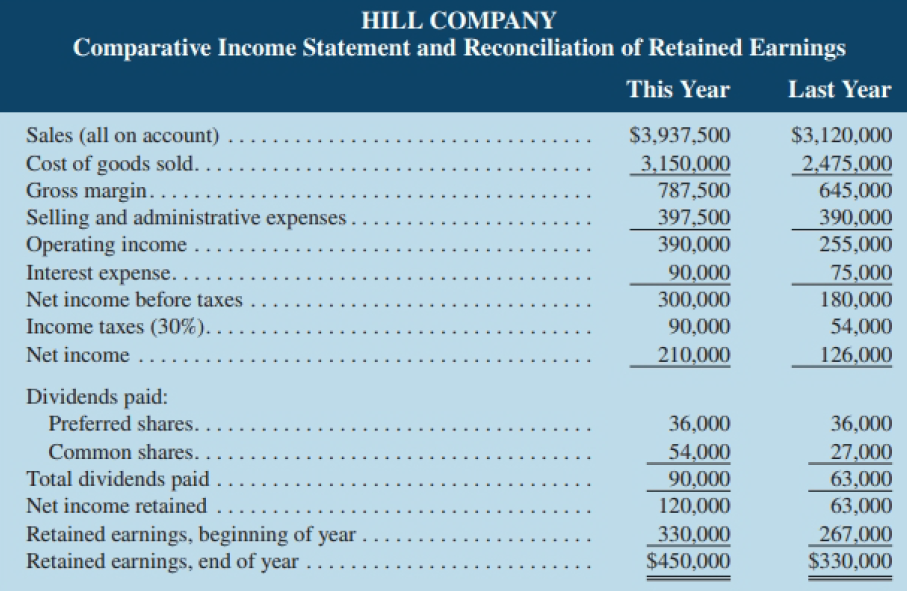

You have just been hired as a loan officer at Westmount Bank. Your supervisor has given you a file containing a request from Hill Company, a manufacturer of computer components, for a $2,000,000 five-year loan. Financial statement data on the company for the past two years are give n below:

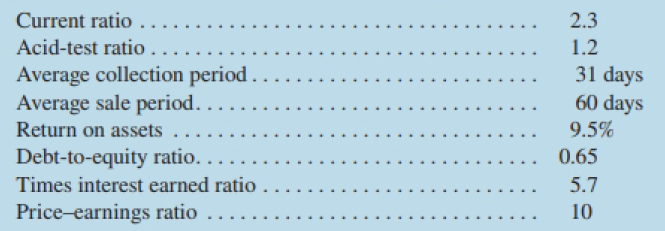

Pat Smith, who just three years ago was appointed president of Hill Company, admits that the company has been inconsistent in its performance over the past several years. But Smith argues that the company has its costs under control and is now experiencing strong sales growth, as evidenced by the more than 25% increase in sales over the past year. Smith also argues that investors have recognized the improving situation at Hill Company, as shown by the jump in the price of its common shares from $15 per share last year to $27 per share this year. Smith believes that with strong leadership and with the modernized equipment that the $2,000,000 loan will permit the company to buy, profits will be even stronger in the future. Anxious to impress your supervisor, you decide to generate all the information you can about the company. You determine that the following ratios are typical of companies in Hill Company's industry:

Required

1. You decide to assess the rate of return that the company is generating first.

a. Compute the return on total assets for both this year and last year. (Total assets at the beginning of last year were $3,240,000.)

b. Compute the return on common shareholders' equity for both this year and last year. (Shareholders' equity at the beginning of last year totalled $2,217,000. There has been no change in preferred or common shares over the past two years.)

c. Is the company's financial leverage positive or negative? Explain.

2. You decide to assess how well the company is doing from the perspective of the common shareholders next. For both this year and last year, compute

a. The earnings per share.

b. The dividend yield ratio for common shares.

c. The dividend payout ratio for common shares.

d. The price-earnings ratio. How do investors regard Hill Company as compared to other companies in the industry? Explain.

e. The book value per common share. Does the difference between market value per share and book value per share suggest that the shares at their current price are a bargain? Explain.

f. The gross margin percentage.

3. You decide, finally, to assess creditor ratios to determine both short-term and long-term debt paying ability. For both this year and last year, compute

a. Working capital.

b. The current ratio.

c. The acid-test ratio.

d. The average collection period. (The accounts receivable at the beginning of last year totalled $390,000.)

e. The average sale period. (The inventory at the beginning of last year totalled $480,000.)

f. The debt-to-equity ratio.

g. The times interest earned.

4. Recommend to your supervisor whether the loan should be approved.

Dividend YieldDividend yield refers to a stock's annual dividend payments to shareholders, expressed as a percentage of the stock's current price. The dividend per share that a company pays divided by the share price. This is reported on the financial statements...

Step by Step Answer:

Managerial Accounting

ISBN: 9781259275814

11th Canadian Edition

Authors: Ray H Garrison, Alan Webb, Theresa Libby